The following information relates to Boogies Boutique: During the year ended 31 December 20*8, the proprietor of

Question:

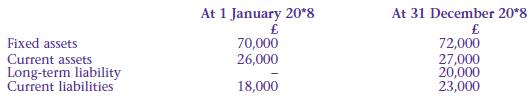

The following information relates to Boogies Boutique:

During the year ended 31 December 20*8, the proprietor of Boogies Boutique introduced a further £9,500 from a private source. She also withdrew £16,500 for personal expenditure.

During the year ended 31 December 20*8, the proprietor of Boogies Boutique introduced a further £9,500 from a private source. She also withdrew £16,500 for personal expenditure.

Required

Calculate the profit or loss for the year ended 31 December 20*8.

Transcribed Image Text:

Fixed assets Current assets Long-term liability Current liabilities At 1 January 20*8 £ 70,000 26,000 18,000 At 31 December 20*8 £ 72,000 27,000 20,000 23,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 83% (6 reviews)

To calculate the profit or loss for the year ended December 31 208 you can use the formula ProfitLos...View the full answer

Answered By

User l_998468

I have extensive tutoring experience, having worked as a private tutor for over three years. I have tutored students from different academic levels, including high school, undergraduate, and graduate levels. My tutoring experience has taught me to be patient, attentive to student needs, and effective in communicating difficult concepts in simple terms.

I have a strong background in statistics, probability theory, data analysis, and data visualization. I am proficient in using statistical software such as R, Python, and SPSS, which are commonly used in academic research and data analysis. Additionally, I have excellent communication and interpersonal skills, which enable me to establish rapport with students, understand their learning styles, and adapt my teaching approach to meet their needs.

I am passionate about teaching and helping students achieve their academic goals.

0.00

0 Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Question 2: What kind of path/steps should the researcher follow, who wants to demonstrate/support the view that "There is a relationship between the COVID-19 spread indicators (cases, number of...

-

The following information relates to Sydney Computer Services. Income Statement for the year ended 30 June 2013 Additional Information: The Owner withdrew $20,000 through the year for her own use....

-

The following information relates to Simrin plc for the year ended 31 December 20X0: Simrin plc had 100,000 ordinary shares of £1 each in issue throughout the year. Simrin plc has in issue...

-

Several industries located along the Ohio River discharge a toxic substance called carbon tetrachloride into the river. The state Environmental Protection Agency monitors the amount of carbon...

-

As a public accountant, you have been contacted by Joe Davison, CEO of Sports-Pro Athletics, Inc., a manufacturer of a variety of athletic equipment. He has asked you how to account for the following...

-

The Apollo Company is a catalogue-based retailer. The following describes Apollos operations in its first two years of business: Required 1. Prepare an income statement for each year assuming that...

-

Describe the steps used to develop, execute, and evaluate an advertising program.

-

Bienestar, Inc., has two plants that manufacture a line of wheelchairs. One is located in Kansas City, and the other in Tulsa. Each plant is set up as a profit center. During the past year, both...

-

morv ( 3 . 5 % ) Chapter > 1 0 0 - 0 b - 0 3 6 5 d = 1 7 - 1 m MULTIPLE CHOICE - Choose the one alternative that best completes the statement or answers the question. An item that may be converted to...

-

On 1 February 20*7 the net assets of Beckys business were 83,000. During the year ended 31 January 20*8 she withdrew 18,000 for her private use. She also paid into the business bank account a premium...

-

The net assets of a business have increased over the year by 2,750. The proprietor paid into the business bank account 35,000, withdrawn from her personal building society account. During the year...

-

Which three statements are least appropriate? A disciplined approach is based on compiling sound evidence from reliable and confirmed sources with the resulting documents put together in a systematic...

-

In 2024, the Westgate Construction Company entered into a contract to construct a road for Santa Clara County for $10,000,000. The road was completed in 2026. Information related to the contract is...

-

Briefly describe the case you have chosen. Categorize the social worker's experience as vicarious trauma, compassion fatigue, or burnout. Provide justification. Identify the social worker's score on...

-

Given f(x) below, find f'(x). f(x) = = m 5z In (2) et dt

-

Olsen & Alain, CPAs (O&A) performed the audit of Rocky Point Brewery (RPB), a public company in 20X1 and 20X2. In 20X2, O&A also performed tax services for the company. Which statement best describes...

-

Exercise 9-4 (Algo) Prepare a Flexible Budget Performance Report [LO9-4] Vulcan Flyovers offers scenic overflights of Mount Saint Helens, the volcano in Washington State that explosively erupted in...

-

Watch the spout of a teakettle of boiling water. Notice that you cannot see the steam that issues from the spout. The cloud that you see farther away from the spout is not steam but condensed water...

-

The time to assemble the first unit on a production line is 10 hours. The learning rate is 0.94. Approximately how long will it take for the seventh unit to be assembled? The number of hours needed...

-

Explain the reason that a statement of financial position will always 'balance'.

-

Explain what is meant by the term 'capital'.

-

What is meant by the term 'trade receivables'?

-

Maddox Resources has credit sales of $ 1 8 0 , 0 0 0 yearly with credit terms of net 3 0 days, which is also the average collection period. Maddox does not offer a discount for early payment, so its...

-

Selk Steel Co., which began operations on January 4, 2017, had the following subsequent transactions and events in its long-term investments. 2017 Jan. 5 Selk purchased 50,000 shares (25% of total)...

-

Equipment with a book value of $84,000 and an original cost of $166,000 was sold at a loss of $36,000. Paid $100,000 cash for a new truck. Sold land costing $330,000 for $415,000 cash, yielding a...

Study smarter with the SolutionInn App