A call spread collar option requires its holder to buy an asset at the price (f(S)) when

Question:

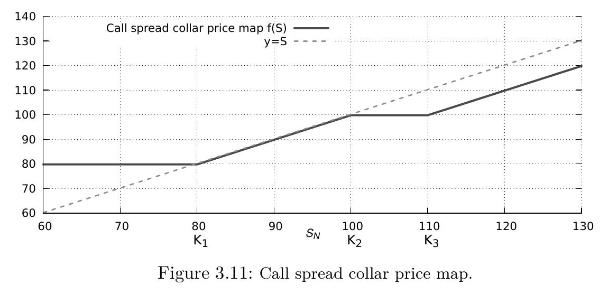

A call spread collar option requires its holder to buy an asset at the price \(f(S)\) when its market price is at the level \(S\), where \(f(S)\) is the function plotted in Figure 3.10, with \(K_{1}:=80, K_{2}:=100\), and \(K_{3}:=110\).

a) Draw the payoff function of the call spread collar as a function of the underlying asset price at maturity.

b) Show that this call spread collar option can be realized by purchasing and/or issuing standard European call and put options with strike prices to be specified.

Hints: Recall that an option with payoff \(\phi\left(S_{N}ight)\) is priced \((1+r)^{-N} \mathbb{E}^{*}\left[\phi\left(S_{N}ight)ight]\) at time 0 . The payoff of the European call (resp. put) option with strike price \(K\) is \(\left(S_{N}-Kight)^{+}\), resp. \(\left(K-S_{N}ight)^{+}\).

Step by Step Answer:

Introduction To Stochastic Finance With Market Examples

ISBN: 9781032288277

2nd Edition

Authors: Nicolas Privault