Consider a risky asset valued (S_{0}=$ 4) at time (t=0), and taking only two possible values (S_{1}

Question:

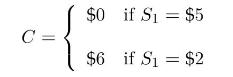

Consider a risky asset valued \(S_{0}=\$ 4\) at time \(t=0\), and taking only two possible values \(S_{1} \in\{\$ 2, \$ 5\}\) at time \(t=1\). Find the portfolio allocation \((\xi, \eta)\) hedging the claim payoff

at time \(t=1\), compute its price \(V_{0}=\xi S_{0}+\$ \eta\) at time \(t=0\), and determine the corresponding risk-neutral probability measure \(\mathbb{P}^{*}\).

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Introduction To Stochastic Finance With Market Examples

ISBN: 9781032288277

2nd Edition

Authors: Nicolas Privault

Question Posted: