Using the financial statements below, a. Compute common-size financial statements. b. Put together a statement of cash

Question:

Using the financial statements below,

a. Compute common-size financial statements.

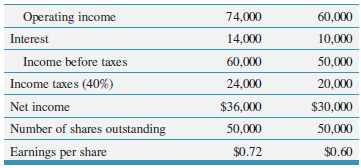

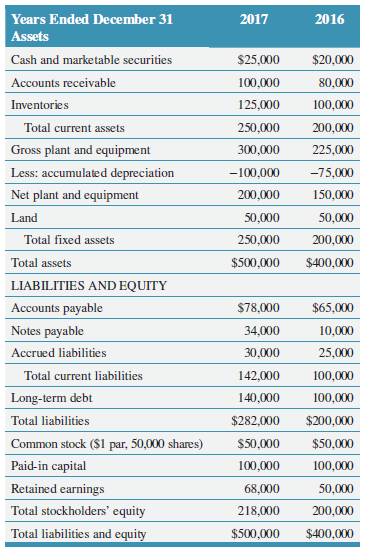

b. Put together a statement of cash flows of the firm. Where did the firm invest funds during the year? How did it finance these purchases? Income Statements for EastNorth Manufacturing, Inc.

Balance Sheets for Eastnorth Manufacturing, Inc.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Years Ended December 31 2017 2016 Net revenues or sales $700,000 $600,000 Cost of goods sold 450,000 375,000 Gross profit 250,000 225,000 Operating expenses: General and administrative 95,000 95,000 Selling and marketing 56,000 50,000 Depreciation 25,000 20,000 Operating income 74,000 60,000 Interest 14,000 10,000 Income before taxes 60,000 50,000 Income taxes (40%) 24,000 20,000 Net income $36,000 $30,000 Number of shares outstanding 50,000 50,000 Earnings per share $0.72 $0.60

Step by Step Answer:

a Balance sheet 2017 2016 2017 2016 ASSETS Cash 25000 20000 50 50 Account receivable 100000 80000 200 200 Inventories 125000 100000 250 250 Total curr...View the full answer

Introduction to Finance Markets, Investments and Financial Management

ISBN: 978-1119398288

16th edition

Authors: Ronald W. Melicher, Edgar A. Norton

Related Video

Depreciation of non-current assets is the process of allocating the cost of the asset over its useful life. The cost of the asset includes the purchase price, any additional costs incurred to bring the asset to its current condition and location, and any other costs that are directly attributable to the asset. The useful life of the asset is the period over which the asset is expected to be used by the company. To calculate the depreciation, companies use different methods such as straight-line, declining-balance, sum-of-the-years\'-digits, units-of-production, and group depreciation. The chosen method will depend on the type of asset, the company\'s accounting policies, and the accounting standards that are applicable. The straight-line method allocates an equal amount of the asset\'s cost over its useful life, while the declining-balance method calculates depreciation at a fixed rate, typically double the straight-line rate, but the amount of depreciation decreases over time. The sum-of-the-years\'-digits method is similar to the declining-balance method, but the rate of depreciation is calculated using a fraction that is based on the useful life of the asset. It\'s important to note that the depreciation expense will be recorded on the company\'s income statement and the accumulated depreciation will be recorded on the company\'s balance sheet. This will decrease the value of the asset on the balance sheet over time.

Students also viewed these Business questions

-

Using the financial statements below for the Global Manufacturing corporation, a. Compute common-size financial statements. b. Put together a statement of cash flows of the firm. Where did the firm...

-

In addition to common-size financial statements, common-base year financial statements are often used. Common-base year financial statements are constructed by dividing the current year account value...

-

In addition to common-size financial statements, common-base-year financial statements are often used. Common-base-year financial statements are constructed by dividing the current-year account value...

-

Sarah is confused about the difference between the perimeter and the area of a polygon. Explain the two concepts and the distinction between them.

-

Compute where: (a) = [3 -1 0]T, = [-6 2 0]T (b) = [2 0 -1]T, = [1 4 7]T

-

Sketch the graph of the equation. Identify any intercepts and test for symmetry. y = -x + 3

-

Explain why we might not want to remove a variable just because it is highly correlated with another variable. EXERCISES 53 HANDS-ON ANALYSIS Use the churn data set14 on the book series web site for...

-

Through process measuring a number of pizza delivery times, Mary Janes Pizzeria finds the mean of all samples to be 27.4 minutes, with an average sample range of 5.2 minutes. They tracked four...

-

A stock had returns of 8 percent, -4 percent, 6 percent, and 14 percent over the past four years. What is the standard deviation of these returns? 7.5 percent 7.0 percent 6.2 percent 6.5 percent 7.8...

-

Late in 2018, Felix Machine Company (FMC) management was considering expansion of the company?s international business activities. FMC is a South Carolina?based manufacturer of compound machines for...

-

Use the following information to construct an income statement: Cost of goods sold...............................................$684,000 Gross...

-

Why is it said that the personal income tax rate in the United States is progressive?

-

The organic chemistry of living cells is said to be special for two reasons: it occurs in an aqueous environment and it accomplishes some very complex reactions. But do you suppose it is really all...

-

Comparative financial statements for Weller Corporation, a merchandising company, for the year ending December 31 appear below. The company did not issue any new common stock during the year. A total...

-

Laker Company reported the following January purchases and sales data for its only product. For specific identification, ending inventory consists of 280 units from the January 30 purchase, 5 units...

-

Compensation (wages) Income taxes withheld $ 36,600 7,680 FICA taxes at a 7.65% rate (no employee had reached the maximum). Required: A. Prepare the March 31, 2022 journal entry to record the payroll...

-

Process Costing and Spoilage Nation Lovers PLC produces several items to be used as replacement tools for various types of machineries. The product costing system for NL which is used as spare part...

-

1. The interest rate charged on a loan of $85,000 is 7.75% compounded annually. If the loan is to be paid off over seven years, calculate the size of the annual payments. 2. A $10,000 debt is repaid...

-

What are some advantages and disadvantages of the specific identification method of accounting for inventory?

-

Why is it important to understand the macro-environment when making decisions about an international retail venture?

-

Indicate for each transaction whether a sales (S) or use (U) tax applies or whether the transaction is nontaxable (N). Where the laws vary among states, assume that the most common rules apply. All...

-

Dread Corporation operates in a high-tax state. The firm asks you for advice on a plan to outsource administrative work done in its home state to independent contractors. This work now costs the...

-

Indicate whether each of the following items should be allocated or apportioned by the taxpayer in computing state corporate taxable income. Assume that the state follows the general rules of UDITPA....

-

More info

-

American Food Services, Incorporated leased a packaging machine from Barton and Barton Corporation. Barton and Barton completed construction of the machine on January 1 , 2 0 2 4 . The lease...

-

Which of the following statements is true? Financial measures tend to be lag indicators that report on the results of past actions. LA profit center is responsible for generating revenue, but it is...

Study smarter with the SolutionInn App