Question:

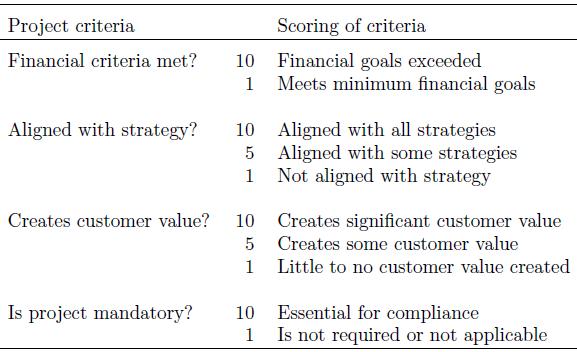

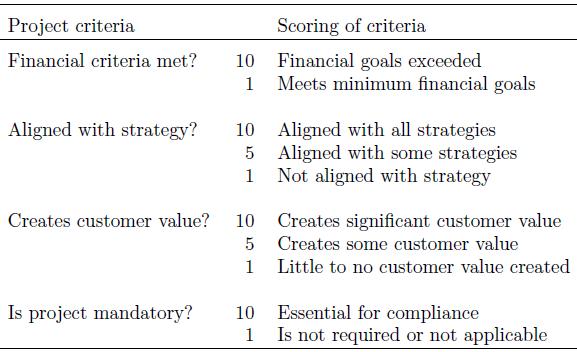

In the capital budgeting discussion of Section 9.2.7, the scoring of project criteria in Table 9.3, seems somewhat arbitrary. Wouldn't it be easy to manipulate the scoring to "fix" the scale so that certain projects are favored? What can be done to avoid this?

Table 9.3,

Transcribed Image Text:

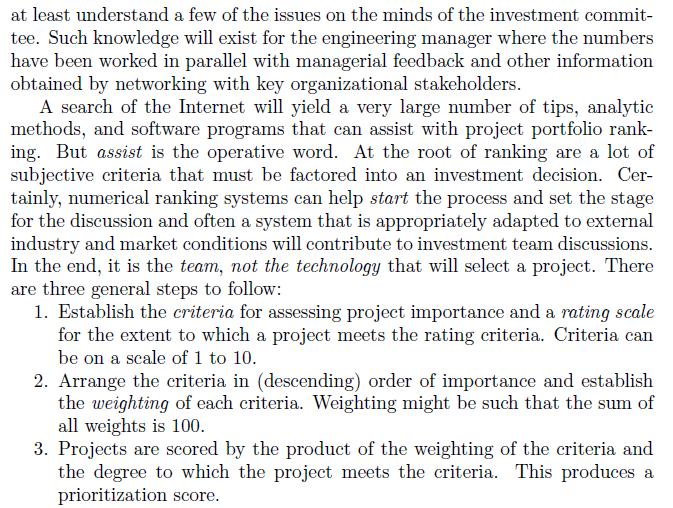

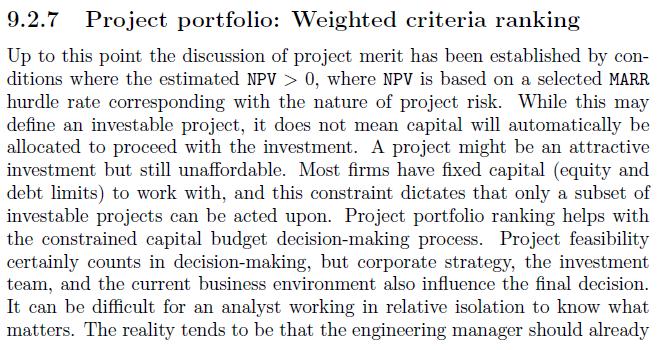

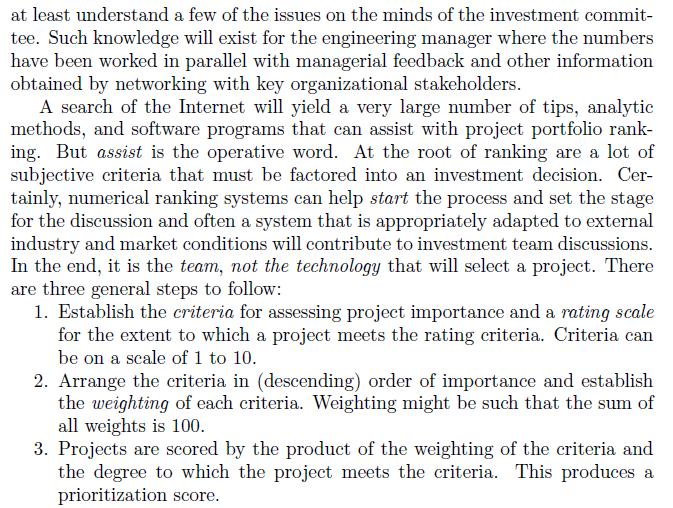

9.2.7 Project portfolio: Weighted criteria ranking Up to this point the discussion of project merit has been established by con- ditions where the estimated NPV > 0, where NPV is based on a selected MARR hurdle rate corresponding with the nature of project risk. While this may define an investable project, it does not mean capital will automatically be allocated to proceed with the investment. A project might be an attractive investment but still unaffordable. Most firms have fixed capital (equity and debt limits) to work with, and this constraint dictates that only a subset of investable projects can be acted upon. Project portfolio ranking helps with the constrained capital budget decision-making process. Project feasibility certainly counts in decision-making, but corporate strategy, the investment team, and the current business environment also influence the final decision. It can be difficult for an analyst working in relative isolation to know what matters. The reality tends to be that the engineering manager should already