Let's assume Bethesda Imaging, Inc. has $$ 30$ million cash on the balance sheet. Executives at the

Question:

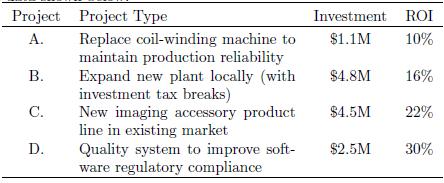

Let's assume Bethesda Imaging, Inc. has $\$ 30$ million cash on the balance sheet. Executives at the annual board meeting passed on any of the investments from the prior year, and correctly anticipated lower profitability for the past year. The new strategy is to set aside $\$ 7.5$ million for future investments. In response, the Chief Operating Officer (COO) went back to her direct reports for investment ideas that

(a) would meet the minimum MARR set forth in Table 9.2 and

(b) would not each exceed a $\$ 4$ million investment cap. The four division managers under the $\mathrm{COO}$ came up with just 4 projects; managers have tried to be persuasive with the value of their proposals with very long documents and supporting studies, but in the end the COO simply extracted the data shown below:

What is the investment portfolio that you would recommend?

Step by Step Answer: