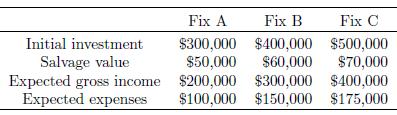

Projects A, B, and C are being considered by a firm with a MARR of $18 %$.

Question:

Projects A, B, and C are being considered by a firm with a MARR of $18 \%$. The company has lagged competitors for years, and changes in the FDA regulations means something must be done soon. Management does not want to deal with the problem again for the foreseeable future and asked for cash-flow estimates for the next 10-year period.

With a maximum capital budget of $\$ 900 \mathrm{~K}$, what combination of projects makes sense to invest in?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: