As of January 2, 2019, you have just completed a discounted cash flow analysis on a $250,000

Question:

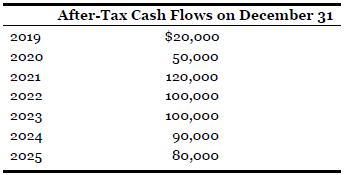

As of January 2, 2019, you have just completed a discounted cash flow analysis on a $250,000 investment. You calculated after-tax cash flows (including the tax savings from the tax shield) for each year. You then determined that the project has a positive net present value using the company’s cost of capital of 15 percent. You reported your findings to your supervisor and recommended that the company make the investment. To your surprise, the supervisor rejected the acquisition. He said that company policy was to not invest in any project in which the cash flows do not recover the initial investment in three years. He points out that of the $250,000 expended, only $190,000 would be recovered in three years.

Required:

A. Complete the net present value analysis showing that the investment should be undertaken.B. Write a memo explaining why the company should make this investment and why the company should scrap its three-year payback rule.

Step by Step Answer:

Introduction To AccountingAn Integrated Approach

ISBN: 9781119600107

8th Edition

Authors: Penne Ainsworth, Dan Deines