Assume that you have been asked to place a value on the fund capital (equity) of BestHealth,

Question:

Assume that you have been asked to place a value on the fund capital

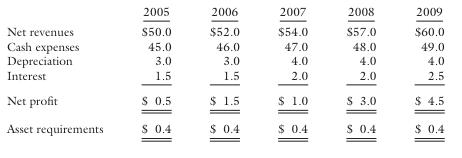

(equity) of BestHealth, a not-for-profit HMO. Its projected profit and loss statements and equity reinvestment (asset) requirements are shown below (in millions):

The cost of equity of similar for-profit HMO’s is 14 percent, while the best estimate for BestHealth’s long-term growth rate is 5 percent.

a. What is the equity value of the HMO?

b. Suppose that it was not necessary to retain any of the operating income in the business. What impact would this change have on the equity value?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Healthcare Finance An Introduction To Accounting And Financial Management

ISBN: 9781567932324

3rd Edition

Authors: Louis Gapenski PhD

Question Posted: