Assume that you have been asked to place a value on the ownership position in Briarwood Hospital.

Question:

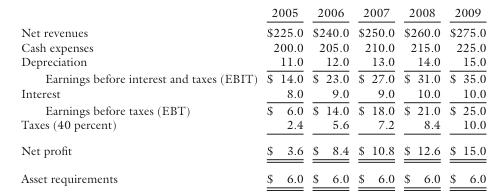

Assume that you have been asked to place a value on the ownership position in Briarwood Hospital. Its projected profit and loss statements and equity reinvestment (asset) requirements are shown below (in millions):

Briarwood’s cost of equity is 16 percent. The best estimate for Briarwood’s long-term growth rate is 4 percent.

a. What is the equity value of the hospital?

b. Suppose that the expected long-term growth rate was 6 percent.

What impact would this change have on the equity value of the business? What if the growth rate were only 2 percent?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Healthcare Finance An Introduction To Accounting And Financial Management

ISBN: 9781567932324

3rd Edition

Authors: Louis Gapenski PhD

Question Posted: