Hora Sporting Goods decided to sell its childrens toy division during 2019. The following relevant information is

Question:

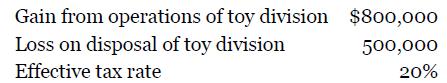

Hora Sporting Goods decided to sell its children’s toy division during 2019. The following relevant information is available. Use this information to determine the income (loss) from operations of the division and the income (loss) upon disposal of the division.

Transcribed Image Text:

Gain from operations of toy division Loss on disposal of toy division Effective tax rate $800,000 500,000 20%

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 53% (13 reviews)

To determine the income loss from operations of the division we only need the information provided a...View the full answer

Answered By

Akash M Rathod

I have been utilized by educators and students alike to provide individualized assistance with everything from grammar and vocabulary to complex problem-solving in various academic subjects. I can provide explanations, examples, and practice exercises tailored to each student's individual needs, helping them to grasp difficult concepts and improve their skills.

My tutoring sessions are interactive and engaging, utilizing a variety of tools and resources to keep learners motivated and focused. Whether a student needs help with homework, test preparation, or simply wants to improve their skills in a particular subject area, I am equipped to provide the support and guidance they need to succeed.

0.00

0 Reviews

10+ Question Solved

Related Book For

Introduction To AccountingAn Integrated Approach

ISBN: 9781119600107

8th Edition

Authors: Penne Ainsworth, Dan Deines

Question Posted:

Students also viewed these Business questions

-

Hora Sporting Goods decided to sell its childrens toy division during 2010. The following relevant information is available. Use this information to determine the income (loss) from operations of the...

-

Refer to E17.3. How does your answer change if the toy division showed a loss from operations of $800,000 and if Hora experiences a gain on disposal of the toy division of $500,000? Show your...

-

Russell-James Corporation is a diversified consumer products company. During 2021, Russell-James discontinued its line of cosmetics, which constituted discontinued operations for financial reporting...

-

Integer sort. Write a linear-time filter that reads from standard input a sequence of integers that are between 0 and 99 and prints to standard output the same integers in sorted order. For example,...

-

Explain why the priorities for liquidation are determined as they are. Do you agree with the order?

-

Do you agree with the rank order of the 10 benefits shown above? What changes would you make to produce your own personal list? LO9

-

3. Prove that the following function is not differentiable at (0,0). < II(x,y)11 < 7r (x,y) = (0,0)

-

Two oppositely charged. Identical insulating spheres, each 50.0 cm in diameter and carrying a uniform charge of magnitude 175 µC are placed 1.00 m apart center to center (Fig). (a) If a...

-

neet 4) Model the linear programming problem for the following scenario: (10 marks) "Do not attempt to solve. Write the objective function and the constraints only . (10 min) Soundex produces two...

-

Richardson Ski Racing (RSR) sells equipment needed for downhill ski racing. One of RSRs products is fencing used on downhill courses. The fence product comes in 150-foot rolls and sells for $215 per...

-

Explain the difference between the Market Value Approach and the Fair Value Option when accounting for available-for sale securities.

-

Julia Barton is responsible for accounting for Equine Inc.s short-and long-term investments. This is Equines first year in business and she reports to you that she has $102,000 of Trading Securities,...

-

(a) Sandwich each of the six commutation relations in Equations 6.526.54 between (n''m'| and |nm) to obtain relations between matrix elements of V. As an example, Equation 6.52 with the upper signs...

-

The Penguin Textile Company sells shirts for men and boys. Results for January 2 0 2 3 are summarized below. Men's Boy's Total Revenue $ 1 7 2 , 8 0 0 $ 7 2 , 0 0 0 $ 2 4 4 , 8 0 0 Variable costs 1 2...

-

SINGLE, MARRIED FILING SEPERATELY, OR HEAD OF HOUSEHOLD SINGLE, MARRIED FILING SEPERATELY, OR HEAD OF HOUSEHOLD Over $0 $12,500 $50,000 But Not Over $12,500 $50,000 Tax Due Is 4% of taxable income...

-

17. S T D -3 -2 graph of glx) 2 The graph of the continuous function g is shown above for -46x4. The Function g is twice differentiable, except at x=0. let & be the function with flo1=-2 and f'(x) =...

-

Tim works for HydroTech, a manufacturer of high-pressure industrial water pumps. He reports directly to the CFO, and she has asked him to calculate HydroTech's WACC. He has gathered the following...

-

You are appraising a 15,450 square foot (SF) building and using the Cost Approach. The base cost is $50/SF, the local multiplier is 1.05, the current cost multiplier is 0.92. The land value is...

-

Several decades ago a large proportion of Americans smoked cigarettes. However, in recent years many adults have quit. To measure the extent of current smoking a random sample of American adults was...

-

The electric field due to a line charge is given by where l is a constant. Show that E is solenoidal. Show that it is also conservative. E =

-

With direct-response promotion, customers provide feedback to marketing communications. How can a marketing manager use this feedback to improve the effectiveness of the overall promotion blend?

-

How can a promotion manager aim a message at a certain target market with electronic media (like the Internet) when the customer initiates the communication? Give an example.

-

What promotion blend would be most appropriate for producers of the following established products? Assume average- to large-sized firms in each case and support your answer. a. Chocolate candy bars....

-

Jen bought 100 shares of ABC stock at $15 a share on July 14, 2017. On August 7, 2018, she noticed that the stock had increased in value to $20 a share and decided to sell her shares. Jen's marginal...

-

Alex. Inci, buys 40 petcent of Steinbart Company on January 1, 2020, for $1.212.000. The equity method of accounting is to be used. Steinbart's net assets on that datewere $2.90 million. Any excess...

-

exercise 4-7 (Algo) Effects of transactions on income statement LO P2

Study smarter with the SolutionInn App