Huey, Louie, and Dewey are forming a dental partnership and are concerned about how to allocate the

Question:

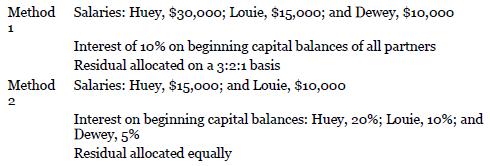

Huey, Louie, and Dewey are forming a dental partnership and are concerned about how to allocate the partnership’s income. Once the partnership is formed, Huey will have $200,000 of capital, while Louie and Dewey will have capital of $100,000 and $50,000, respectively. The partnership is considering the following two methods of allocating the company’s income:

Required:

1. Show how the following income and loss amounts would be allocated under each of the two methods.2. Determine the projected ending capital balances that would result after the allocations from part (1) above.3. Discuss some reasons the partners might have used to justify each of these income allocation methods.A. Net income of $150,000B. Net income of $50,000C. Net loss of $30,000

Step by Step Answer:

Introduction To AccountingAn Integrated Approach

ISBN: 9781119600107

8th Edition

Authors: Penne Ainsworth, Dan Deines