When a company computes an employees withholdings for income taxes, they use the information provided by the

Question:

When a company computes an employee’s withholdings for income taxes, they use the information provided by the employee on the employee’s W-4, which indicates the employee’s filing status (married, single, etc.) and the number of dependents. An employee is not allowed to determine a flat amount to be deducted each payroll period. Assume that you are working in the payroll department of a large corporation and you notice that a new employee has filled out a W-4 claiming 10 dependents. You went to high school with this particular person and happen to know that the person is single and has no children. What should you do?

![]()

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

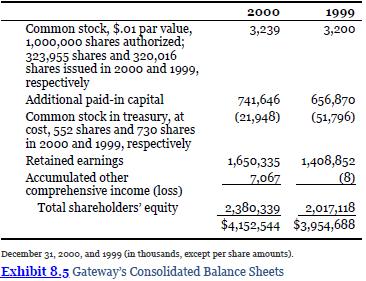

Related Book For

Introduction To AccountingAn Integrated Approach

ISBN: 9781119600107

8th Edition

Authors: Penne Ainsworth, Dan Deines

Question Posted: