7. Galileos functional currency (intermediate). The U.S. multinational manufacturer of drilling and seismic instruments Galileo Ltd. (GLL)

Question:

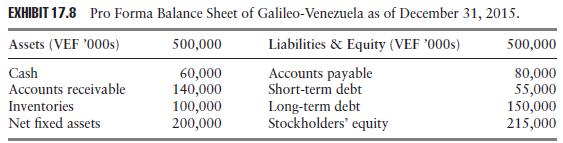

7. Galileo’s functional currency (intermediate). The U.S. multinational manufacturer of drilling and seismic instruments Galileo Ltd. (GLL) is reviewing the rapid deterioration of the Venezuelan economy and how it may impact its consolidated accounts. The bolivar (VEF) is currently officially trading at VEF 4.5 =

US$1 but, with cumulative inflation over the past three years approaching 125 percent, another maxi-devaluation is widely anticipated.

a. Referring to the GLL-Venezuela pro forma balance sheet shown in Exhibit 17.8, determine GLL’s translation exposure in bolivars. Would your answer be different if Venezuela’s cumulative inflation over the past three years had been 75 percent instead of 125 percent?

b. Assuming that the bolivar will depreciate by year-end to VEF 6 = US$1, what would GLL’s translation loss be? How would it be reported?

c. GLL-Venezuela borrows an additional VEF 30,000,000 to pay dividends to its U.S. parent. How would GLL’s bolivar exposure be changed?

Step by Step Answer: