Lanice J. Corporation disposed of its building in Victoria, B.C. The facts relating to the disposition were

Question:

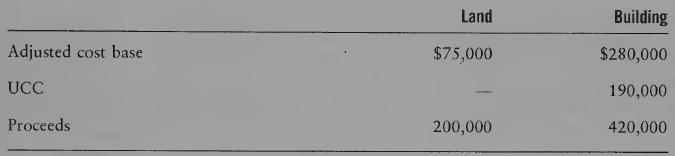

Lanice J. Corporation disposed of its building in Victoria, B.C. The facts relating to the disposition were as follows:

REQUIRED

Compute the corporation’s taxable capital gain and recapture.

Transcribed Image Text:

Adjusted cost base UCC Proceeds Land $75,000 200,000 Building $280,000 190,000 420,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 40% (5 reviews)

The calculation of the depreciation recapture if a...View the full answer

Answered By

Aysha Ali

my name is ayesha ali. i have done my matriculation in science topics with a+ . then i got admission in the field of computer science and technology in punjab college, lahore. i have passed my final examination of college with a+ also. after that, i got admission in the biggest university of pakistan which is university of the punjab. i am studying business and information technology in my university. i always stand first in my class. i am very brilliant client. my experts always appreciate my work. my projects are very popular in my university because i always complete my work with extreme devotion. i have a great knowledge about all major science topics. science topics always remain my favorite topics. i am also a home expert. i teach many clients at my home ranging from pre-school level to university level. my clients always show excellent result. i am expert in writing essays, reports, speeches, researches and all type of projects. i also have a vast knowledge about business, marketing, cost accounting and finance. i am also expert in making presentations on powerpoint and microsoft word. if you need any sort of help in any topic, please dont hesitate to consult with me. i will provide you the best work at a very reasonable price. i am quality oriented and i have 5 year experience in the following field.

matriculation in science topics; inter in computer science; bachelors in business and information technology

_embed src=http://www.clocklink.com/clocks/0018-orange.swf?timezone=usa_albany& width=200 height=200 wmode=transparent type=application/x-shockwave-flash_

4.40+

11+ Reviews

14+ Question Solved

Related Book For

Introduction To Federal Income Taxation In Canada 2016-2017

ISBN: 9781554968725

37th Edition

Authors: Robert E. Beam, Stanley N. Laiken, James J. Barnett

Question Posted:

Students also viewed these Business questions

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

James Fish Distributors Inc. (JFDI) is a Canadian-controlled private corporation located in Burnaby, British Columbia. The companys income for tax purposes for its December 31, 2016 taxation year end...

-

Steve Drake sells a rental house on January 1, 2012, and receives $130,000 cash and a note for $55,000 at 10 percent interest. The purchaser also assumes the mortgage on the property of $45,000....

-

World Information Group has two major divisions: print and Internet. Summary financial data (in millions) for 2011 and 2012 are: The annual bonuses of the two division managers are based on division...

-

Marriott International, Inc., and Wyndham Worldwide Corporation are two major owners and managers of lodging and resort properties in the United States. Abstracted income statement information for...

-

On doubling the particle size from R to 2R the time for complete conversion triples. What is the contribution of ash diffusion to the overall resistance for particles of size R?

-

From the following data, calculate (a) BEP (in units). (b) If sales are 10% and 15% above the breakeven volume, determine the net profit. Selling price per unit = Rs 10 Direct material per unit = Rs...

-

Suppose, in the Solow growth model, that learning by doing is captured as a cost of installing new capital. In particular, suppose that for each unit of investment, r units of goods are used up as a...

-

Question 5: The Information below is taken from production department of Salalah Company for August: The number of units produced is 20000. All amounts are in OMR. Total Costs Variable Cost Fixed...

-

A taxpayer purchased a yacht in 2008 at a cost of $24,000. In 2011, the taxpayer changed the use and rented the yacht for the next two years. The fair market value at the time the property became an...

-

Trudeau Limited owned a real property which it sold during the current taxation year for a total of $200,000. The land had a fair market value of $150,000 and an adjusted cost base of $100,000. The...

-

Find f xx (x, y) and f x y (x, y). f(x, y) = 3x 2 y 3 + x 3 y

-

Using a ruler and set squares only, construct the following shapes: a. b. c. d. 5cm 5cm

-

The marketing department has just forecast that 10,000 units of item 778 will be ordered in the next fiscal year. Based on the marketing department's forecast and noting that the seasonal relative...

-

Following are interaction plots for three data sets. Which data set has the largest interactions? Which has the smallest? A B C

-

From your local chamber of commerce, obtain the population figures for your city for the years \(1980,1990,2000\), and 2010. Find the rate of growth for each period. Forecast the population of your...

-

A mass \(m\) is attached at the midpoint of a stretched wire of area of cross-section \(A\), length \(l\), and Young's modulus \(E\) as shown in Fig. 13.29. If the initial tension in the wire is...

-

Describe monopolistic competition, oligopoly, and monopoly.

-

CdF2 (s) Cd+ (aq) + 2 F- (aq) 1. A saturated solution of CdF2 is prepared. The equilibrium in the solution is represented above. In the solution [Cd+] eq = 0.0585 M and [F-] eq = 0.117 M. a....

-

Consider each of the following independent fact situations: (1) An individual transfers his or her unincorporated business to a corporation primarily to obtain the benefit of the small business...

-

Kristie owns 35% of Big City Developments Inc. (BCD), which has a December 31 year end. She is also an employee of the company. On March 31, Year 1, she purchased her shares of BCD from treasury for...

-

As the auditor for Skies Limited, a Canadian-controlled private corporation, you have discovered in 80-5-147-1472 your 2012 year-end audit several items that require further consideration. Mr. Scott...

-

Indicate whether the following managerial policy increases the risk of a death spiral:Use of low operating leverage for productionGroup of answer choicesTrueFalse

-

It is typically inappropriate to include the costs of excess capacity in product prices; instead, it should be written off directly to an expense account.Group of answer choicesTrueFalse

-

Firms can avoid the death spiral by excluding excess capacity from their activity bases. Group of answer choicesTrueFalse

Study smarter with the SolutionInn App