James Fish Distributors Inc. (JFDI) is a Canadian-controlled private corporation located in Burnaby, British Columbia. The companys

Question:

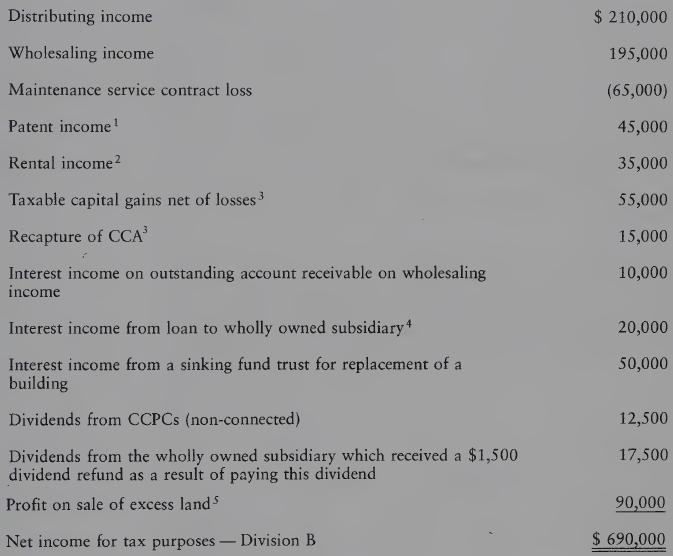

James Fish Distributors Inc. (JFDI) is a Canadian-controlled private corporation located in Burnaby, British Columbia. The company’s income for tax purposes for its December 31, 2016 taxation year end was calculated correctly as follows:

1 The patent income has been determined to be property income.

2 The rental income was derived from leasing the entire space on a 5-year lease in an unused warehouse in a small town in the northern part of the province.

3 The net taxable capital gain and the recapture concerned the disposition of certain specialized maintenance service equipment.

4 The funds were used to buy equipment for its active business.

5 The land had been held for approximately 5 years. It was purchased with the intent of realizing a profit on sale.

Additional Information:

(1) JFDI made the following selected payments during the year:

Charitable donations ............................................... 22,500

Dividends paid in 2016 ........................................... 37,500

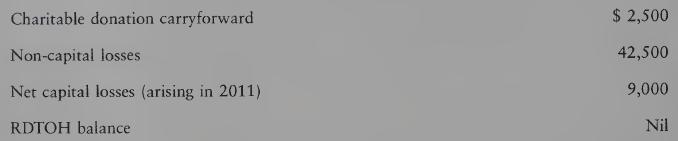

(2) The balances in the tax accounts on January 1, 2016 were:

(3) Taxable income earned in British Columbia, which is the only Canadian jurisdiction in which JFDI operates.

(4) The full business limit is allocated to JFDI.

REQUIRED

(1) Calculate the federal tax and provincial tax at an assumed net rate of 10% on federal taxable income payable by the company for 2016.

(2) Compute the refundable dividend tax on hand balance as at December 31, 2016, and compute the dividend refund for 2016.

Step by Step Answer:

Introduction To Federal Income Taxation In Canada 2016-2017

ISBN: 9781554968725

37th Edition

Authors: Robert E. Beam, Stanley N. Laiken, James J. Barnett