VTL Limited is a Canadian-controlled private corporation with its first fiscal year ended December 31, 2016. The

Question:

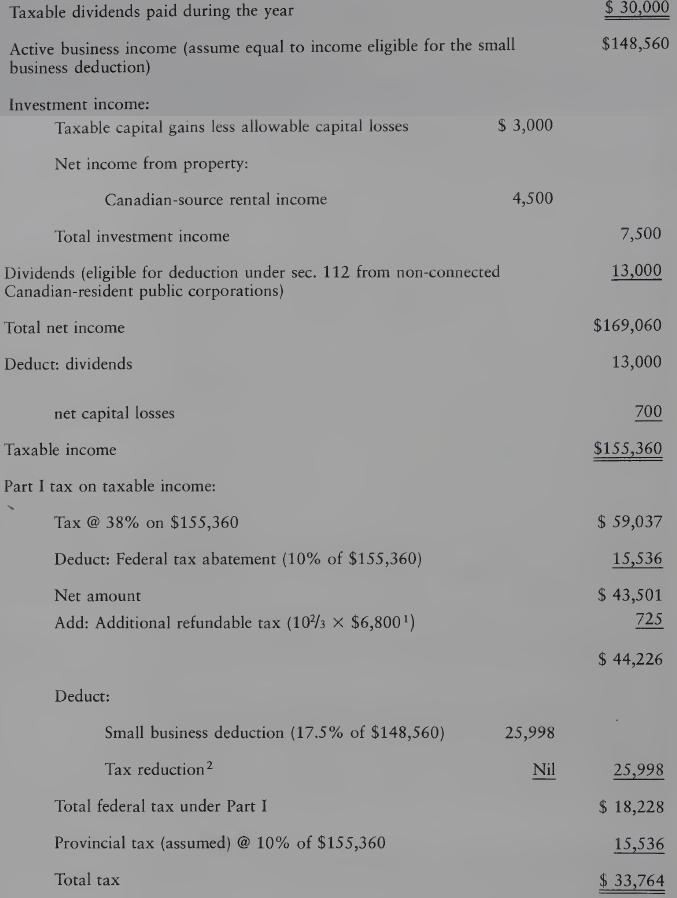

VTL Limited is a Canadian-controlled private corporation with its first fiscal year ended December 31, 2016. The following data resulted in the indicated computation of taxable income and Part I tax payable:

1102/3 X lesser of:

(1) All ($3,000 + $4,500 - $700) = $6,800

(2) TI - SBD amount ($155,360 - $148,560) = $$6,800

2There is no tax reduction in this case, since all active business income is eligible for the small business deduction and any other income of this CCPC is aggregate investment income.

REQUIRED

Compute the refundable dividend tax on hand at the end of the 2016 taxation year and the dividend refund for the 2016 taxation year.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Introduction To Federal Income Taxation In Canada 2016-2017

ISBN: 9781554968725

37th Edition

Authors: Robert E. Beam, Stanley N. Laiken, James J. Barnett

Question Posted: