Mr. Alex Otto acquired an automobile on July 1, 2016, to be used in connection with his

Question:

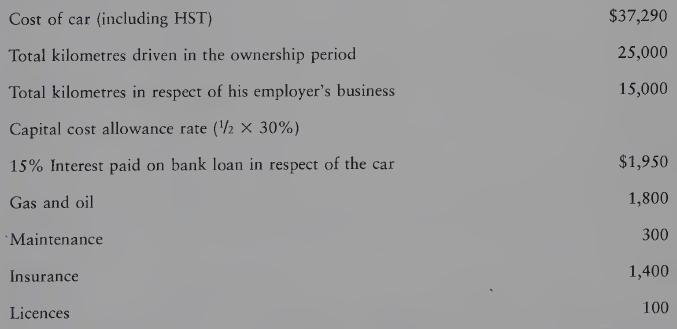

Mr. Alex Otto acquired an automobile on July 1, 2016, to be used in connection with his duties of employment. Alex is required by contract to use his own car and to pay directly all the expenses. Alex does not have any commission income. The following information, some of which is estimated, relates to the newly acquired car:

Alex lives in a province which has an HST rate of 13%.

REQUIRED

Determine the amount deductible in the taxation year in respect of the car expenditures in the following situations, on the assumption that the above expenses were reasonable and ignoring the effects of any leap year:

(1) No kilometre allowance was received;

(2) A reasonable allowance of 38¢ per kilometre in respect of employment driving was received;

(3) An unreasonable allowance of 5¢ per kilometre in respect of employment driving was received;

(4) A reasonable allowance of 25¢ per kilometre in respect of employment driving plus a yearly allowance of $2,000 was received;

(5) An unreasonable allowance of $1 per kilometre in respect of employment driving was received.

Step by Step Answer:

Introduction To Federal Income Taxation In Canada 2016-2017

ISBN: 9781554968725

37th Edition

Authors: Robert E. Beam, Stanley N. Laiken, James J. Barnett