Mr. Black and Mr. Red operate accounting practices as sole practitioners. They wish to form a partnership

Question:

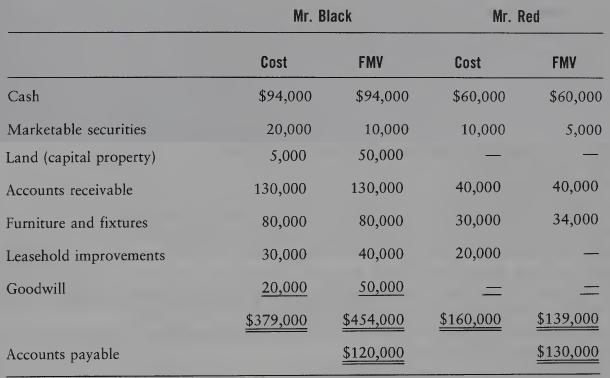

Mr. Black and Mr. Red operate accounting practices as sole practitioners. They wish to form a partnership in which Mr. Black will hold a 60% share and Mr. Red a 40% share. The relevant financial data for the separate practices as at December 31 of this year are as follows;

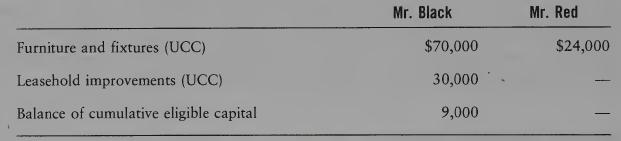

The tax values of the following assets are:

REQUIRED

(1) Compute the values at which the assets should be transferred to defer any immediate tax consequences of the transfer assuming the accounts payable are not transferred to the partnership and no consideration other than a partnership interest is received.

(2) Compute the adjusted cost bases of the partnership interests of Mr. Black and Mr. Red.

(3) Indicate the tax effects of having the partnership assume the accounts payable of Mr. Black and Mr. Red.

(4) Indicate the tax consequences to Mr. Black and Mr. Red of having the partnership dispose of the land next year for proceeds of disposition of $50,000. Assume that the land is capital property to the partnership, and that no consideration, other than a partnership interest, is received by the partners.

Step by Step Answer:

Introduction To Federal Income Taxation In Canada 2016-2017

ISBN: 9781554968725

37th Edition

Authors: Robert E. Beam, Stanley N. Laiken, James J. Barnett