Mr. Moyer has income under Division B of $25,000 and $30,000 for 2015 and 2016, respectively. His

Question:

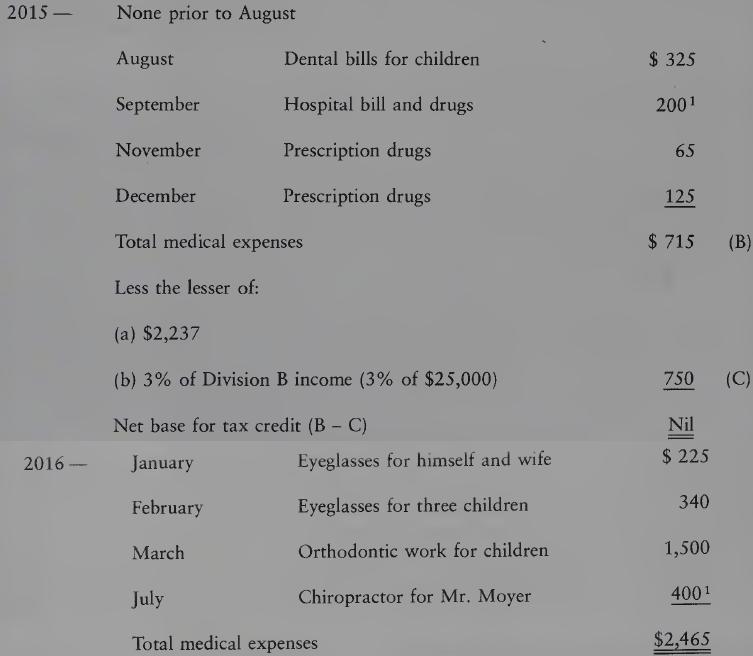

Mr. Moyer has income under Division B of $25,000 and $30,000 for 2015 and 2016, respectively. His wife and children have no income in these years. He incurs the following receipted medical expenses on behalf of himself, his wife, and three dependent children.

1Excess over amount paid by a provincial medicare program.

REQUIRED

Determine the maximum amount Mr. Moyer can claim as a medical expense tax credit in 2016.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Introduction To Federal Income Taxation In Canada 2016-2017

ISBN: 9781554968725

37th Edition

Authors: Robert E. Beam, Stanley N. Laiken, James J. Barnett

Question Posted: