George, age 50, has the following dependants, each of whom has Division B income as indicated for

Question:

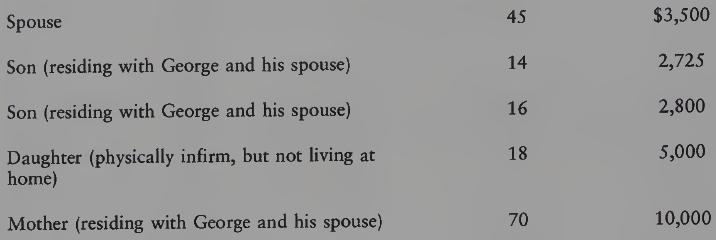

George, age 50, has the following dependants, each of whom has Division B income as indicated for 2016:

REQUIRED

Determine the personal tax credits available under section 118 for each of George’s dependants for 2016. All of the dependants live with George.

Transcribed Image Text:

Spouse Son (residing with George and his spouse) Son (residing with George and his spouse) Daughter (physically infirm, but not living at home) Mother (residing with George and his spouse) 45 14 16 18 70 $3,500 2,725 2,800 5,000 10,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (6 reviews)

Note that neither of the sons provides a dependant t...View the full answer

Answered By

Umber Talat

I am providing full time mentoring and tutoring services in Business Finance, Contemporary issue in Global Economy, Quantitative Techniques, Principles of Marketing, strategic marketing, International Marketing, Organizational Behavior (OB), Consumer Behavior, Sales Force Management, Strategic Brand Management, Services Marketing, Integrated Marketing Communication (IMC), Principles of Management, General Management, Strategic Management, Small and Medium Enterprise Management, Innovation Management, Change Management, Knowledge Management, Strategic Planning, Operations Management, Supply Chain Management, Logistics Management, Inventory management, Total Quality Management (TQM), Productions Management, Project Management, Production Planning, Human Resource Management (HRM), Human Resource Development, Strategic HRM, Organizational Planning, Performance and Compensation Management, Recruitment and Selection, Organizational Development, Global Issues in Human Resource Management, Retail Marketing, Entrepreneurship, Entrepreneurial Marketing, International Business, Research Methods in Business, Business Communication, Business Ethics.

4.70+

158+ Reviews

236+ Question Solved

Related Book For

Introduction To Federal Income Taxation In Canada 2016-2017

ISBN: 9781554968725

37th Edition

Authors: Robert E. Beam, Stanley N. Laiken, James J. Barnett

Question Posted:

Students also viewed these Business questions

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-4. Ivan and Irene paid the following in 2012 (all by check or can otherwise be...

-

Abstract George is in charge of a project to resolve the issue of significant traffic delays in a freeway in Houston, TX. The proposed resolution is to add a lane to each side of the freeway to...

-

Recall the heat equation which we solved numerically T= = DTxx There we implemented an explicit numerical scheme (FTCS) which led to a conditionally stable solution - meaning that for certain time...

-

The following data are taken from the financial statements of Encore Technology Inc. Terms of all sales are 2/10, n/45. a. For 2012 and 2011, determine (1) The accounts receivable turnover and (2)...

-

Using a multilevel page table can reduce the physical memory consumption of page tables, by only keeping active PTEs in physical memory. How many levels of page tables will be needed in this case?...

-

List the pricing practices that are illegal or unethical.

-

In the December 31, 2017, consolidated balance sheet of Patrick and its subsidiary, what amount of total stockholders' equity should be reported? a. $1,100,000 b. $1,125,000 c. $1,150,000 d....

-

Product - Costing Accuracy, Consumption Ratios, Activity Rates, Activity Costing \ table [ [ Product , Machine Hours,Setups,Receiving Orders,Packing Orders ] , [ Infantry , 2 0 , 0 0 0 , 3 0 0 , 9 0...

-

Mr. Moyer has income under Division B of $25,000 and $30,000 for 2015 and 2016, respectively. His wife and children have no income in these years. He incurs the following receipted medical expenses...

-

Larry Hewitt provides you with the following income (losses) for tax purposes for the years 2014 to 2016: Larry also provides the following additional information: (1) Loss carryovers: (2) Larry did...

-

Explain the following statement: Unlike with cost leadership where a firm examines how to reduce costs along its value chain, with differentiation one looks to maximize value along each level of the...

-

The curved rod has a diameter \(d\). Determine the vertical displacement of end \(B\) of the rod. The rod is made of material having a modulus of elasticity of \(E\). Consider only bending strain...

-

If the inertial measurement system were written in C++ according to the design fragment described in Chapter 5, describe the testing strategy you would use. If possible, try to design some test cases.

-

Determine the displacement at point \(C\) of the W14 \(\times 26\) beam made from A992 steel. 8 kip A -5 ft 5 ft. B C -5 ft 5 ft- 8 kip D

-

The beam is subjected to the loading shown. Determine the slope at \(B\) and displacement at \(C\). \(E I\) is constant. Ta Mo C b B

-

A mass, connected to a damper as shown in Fig. 14.30, is subjected to a force \(F(t)\). Find the frequency-response function \(H(\omega)\) for the velocity of the mass. m F(t) y(1) FIGURE 14.30...

-

What motivated you to enroll at University and pursue a degree in higher education? 2. How is motivation important for student success? 3. Explain how participating in the discussion forums can help...

-

a. What is the cost of borrowing if Amarjit borrows $28 500 and repays it over a four-year period? b. How many shares of each stock would he get if he used the $28 500 and invested equally in all...

-

When are C corporations required to make estimated tax payments? How are these payments calculated?

-

Schedule M1 of Form 1120 is used to reconcile financial net income with taxable income reported on the corporations income tax return as follows: net income per books + additions subtractions =...

-

In the current year, Woodpecker, Inc., a C corporation with $8.5 million in assets, deducted amortization of $40,000 on its financial statements and $55,000 on its Federal tax return. Is Woodpecker...

-

A firm purchased a new piece of equipment with an estimated useful life of eight years. The cost of the equipment was $65,000. The salvage value was estimated to be $10,000 at the end of year 8....

-

5. Which of the following is the cheapest for a borrower? a. 6.7% annual money market basis b. 6.7% semi-annual money market basis c. 6.7% annual bond basis d. 6.7% semi-annual bond basis.

-

Waterloo Industries pays 30 percent corporate income taxes, and its after-tax MARR is 24 percent. A project has a before-tax IRR of 26 percent. Should the project be approved? What would your...

Study smarter with the SolutionInn App