A close friend became unemployed six months ago when the company she was working for was forced

Question:

A close friend became unemployed six months ago when the company she was working for was forced into liquidation due to severe cash flow problems. After months of applications and interviews, she has received two job offers, one of which is from Chopper Plc. Before making a decision your friend wishes to obtain as much information as possible about the two companies and has asked for your assistance. She has provided you with the following information in respect to Chopper Plc.

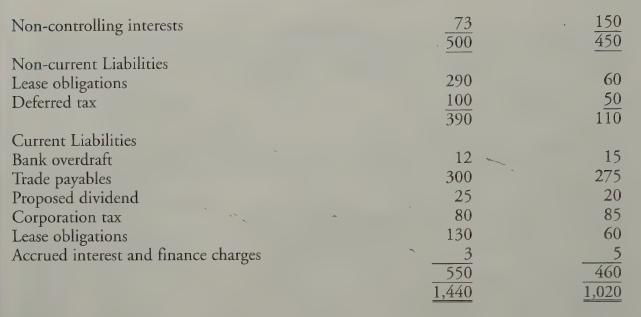

Chopper plc prepares its financial statements to 31 December each year. The company’s consolidated statement of profit or loss and other comprehensive income for the years ended 31 December 2016 and 2017, together with the consolidated statement of financial position as at those dates, are presented below.

Additions during 2017 include right-of-use assets acquired under lease contracts that were initially measured at cost of €400 million in accordance with IFRS 16 Leases. None of the assets disposed of during 2017 were held under lease contracts.

2. On 30 June 2017 Chopper plc disposed of all of its 75% interest in Kingpin Limited for €160 million in cash. Kingpin Limited’s results are classified as discontinued in the consolidated statement of profit or loss and other comprehensive income. The net profit for the year for discontinued operations shown in the consolidated statement of profit or loss and other comprehensive income comprises:

At 30 June 2017 the consolidated carrying values of the assets and liabilities of Kingpin Limited were as follows:

Apart from the sale of Kingpin Limited, there were no other acquisitions or disposals of subsidiary undertakings during 2017. It is group policy to provide a full year’s depreciation charge in the year of acquisition and none in the year of disposal.

3. During the year ended 31 December 2017, dividends of €25 million were debited to equity.

Requirement

(a) Prepare a consolidated statement of cash flows for the year ended 31 December 2017 for Chopper plc in accordance with IAS 7 Statement of Cash Flows.

(b) Prepare a reconciliation of operating profit to operating cash flows that clearly distinguishes between net cash flows from continuing and discontinued operations.

Step by Step Answer:

International Financial Accounting And Reporting

ISBN: 9781912350025

6th Edition

Authors: Ciaran Connolly