Assume that the payroll records of a district sales office of Panasonic Corporation provided the following information

Question:

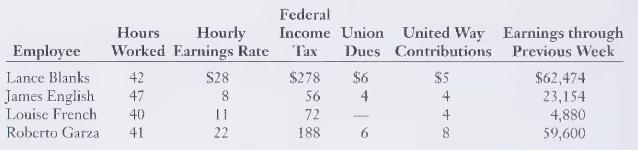

Assume that the payroll records of a district sales office of Panasonic Corporation provided the following information for the weekly pay period ended December 21, 19X5:

James English and Louise French work in the office, and Lance Blanks and Roberto Garza work in sales. All employees are paid time and a half for hours worked in excess of 40 per week. For convenience, round all amounts to the nearest dollar. Show computations. Explanations are not required for journal entries.

\section*{Required}

1. Enter the appropriate information in a payroll register similar to Exhibit 11-6. In addition to the deductions listed, the employer also takes out FICA tax: 8 percent of the first \(\$ 60,000\) of each employee's annual earnings.

2. Record the payroll information in the general journal.

3. Assume that the first payroll check is number 319 , paid to Lance Blanks. Record the check numbers in the payroll register. Also, prepare the general journal entry to record payment of net pay to the employees.

4. The employer's payroll taxes include FICA tax of 8 percent of the first \(\$ 60,000\) of each employee's earnings. The employer also pays unemployment taxes of 6.2 percent ( 5.4 percent for the state and 0.8 percent for the federal government on the first \(\$ 7,000\) of each employee's annual earnings). Record the employer's payroll taxes in the general journal.

Step by Step Answer:

Financial Accounting

ISBN: 9780133118209

2nd Edition

Authors: Charles T. Horngren, Jr. Harrison, Walter T.