Calculating book values; allocating dividends between preferred and common stock (L.O. 4, 6) Part 1. The balance

Question:

Calculating book values; allocating dividends between preferred and common stock (L.O. 4, 6)

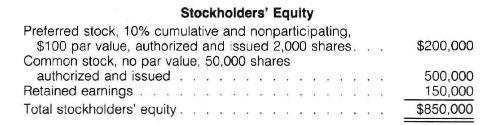

Part 1. The balance sheet of Romero Services Corporation includes the following information:

\section*{Required}

Assume that the preferred stock has a redemption value of \(\$ 106\) plus any dividends in arrears. Calculate the book value per share of the preferred and common stocks under each of the following assumptions:

a. There are no dividends in arrears on the preferred stock.

\(b\). One year's dividends are in arrears on the preferred stock.

c. Three years' dividends are in arrears on the preferred stock.

Part 2. Since its organization, Transom Corporation has had outstanding 5,000 shares of \(\$ 100\) par value, \(12 \%\), preferred stock and 75,000 shares of \(\$ 10\) par value common stock. No dividends have been paid this year, and none were paid during either of the past two years. However, the company has recently prospered and the board of directors wants to know how much cash will be required for dividends if a \$2.30 per share dividend is paid on the common stock.

\section*{Required}

Prepare a schedule that shows the amounts of cash required for dividends to each class of stockholders under each of the following assumptions:

a. The preferred stock is noncumulative and nonparticipating.

\(b\). The preferred stock is cumulative and nonparticipating.

c. The preferred stock is cumulative and fully participating.

d. The preferred stock is cumulative and participating to \(14 \%\).

Step by Step Answer: