Colgate-Palmolive Company uses the LIFO method for inventories. In a recent annual report, Colgate-Palmolive reported these amounts

Question:

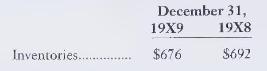

Colgate-Palmolive Company uses the LIFO method for inventories. In a recent annual report, Colgate-Palmolive reported these amounts on the balance sheet (in millions):

A note to the financial statements indicated that if current cost (approximate FIFO) had been used, inventories would have been higher by \(\$ 30\) million at the end of \(19 \mathrm{X} 9\) and higher by \(\$ 28\) million at the end of \(19 \mathrm{X} 8\). The income statement reported sales revenue of \(\$ 6,060\) million and cost of goods sold of \(\$ 3,296\) million for \(19 \mathrm{X} 9\).

\section*{Required}

1. Show the computation of Colgate-Palmolive's cost of goods sold and gross margin for 19X9 by the LIFO method as actually reported.

2. Compute Colgate-Palmolive's cost of goods sold and gross margin for \(19 \mathrm{X} 9\) by the FIFO method.

3. Which method makes the company look better in 19X9? Give your reason. If Colgate-Palmolive used the FIFO method, what would be the amount of inventory profit for 19X9?

4. Assume an income tax rate of 35 percent. How much in taxes did Colgate-Palmolive save by using LIFO?

5. How will what you learned in this problem help you

(a) evaluate an investment;

(b) manage a business?

Step by Step Answer:

Financial Accounting

ISBN: 9780133118209

2nd Edition

Authors: Charles T. Horngren, Jr. Harrison, Walter T.