Franklin Ltd (Franklin) is an Irish company that sells bathroom equipment direct to the public from two

Question:

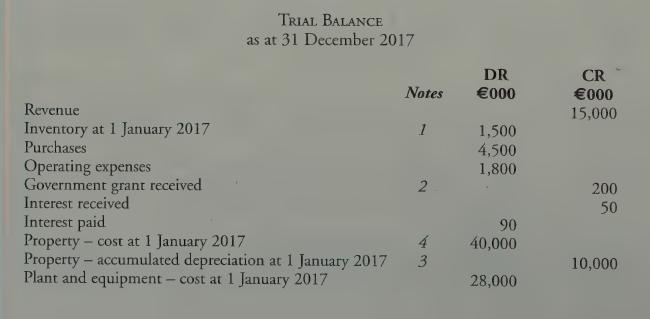

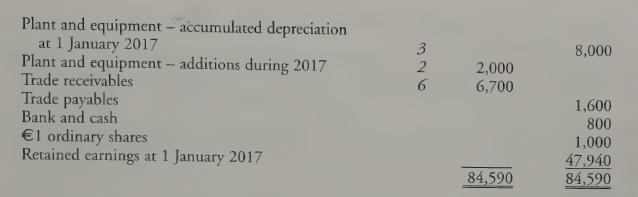

Franklin Ltd ("Franklin") is an Irish company that sells bathroom equipment direct to the public from two large outlets in different areas of Ireland. The company prepares its financial statements to 31 December each year and the following trial balance has been prepared as at 31 December 2017.

1. Inventory at 31 December 2017 was valued at 1,300,000.

2. A government grant of 200,000 was received during the year ended 31 December 2017 in respect of the additions to plant and equipment.

3. It is company policy to charge a full year's depreciation in the year of acquisition and none in the year of disposal. Property is depreciated on a straight-line basis over 40 years. Plant and equipment is depreciated at 10% per annum on a straight-line basis. Depreciation is charged to operating expenses.

4. Property shown in the trial balance at 31 December 2017 consists of two retail premises purchased on the same date at 20,000,000 each. At 31 December 2017, the directors of Franklin are committed to a plan to sell one of these properties. This is part of a single co-ordinated plan to dispose of a separate geographical area of the company's operations and the directors have already found a potential buyer. The net sales proceeds are expect- ed to be 23,000,000. As soon as the sale has been agreed, Franklin will vacate the prop- erty and transfer it to the new owners. While this process is expected to take a number of months to complete, no unusual delays are anticipated.

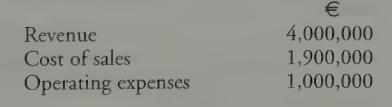

5. As part of the decision to sell one of the company's properties referred to in Note 4, the directors of Franklin decided to run down those parts of the company's activities that represented the separate geographical area of operations. These activities were finally discontinued in December 2017 and the contribution to the business of these activities in 2017 was:

These amounts are included in the corresponding figures shown in the Trial Balance at 31 December 2017. Apart from the figures shown above, all other amounts shown in the Trial Balance at 31 December 2017, and adjustments to Franklin's financial statements for the year ended 31 December 2017 relate to continuing operations.

6. On 1 December 2017 Franklin factored a trade receivable of 500,000 to Aretha Finance Ltd ("Aretha"). The terms of the factoring agreement were: Aretha paid 80% of the factored debt immediately to Franklin; the remaining 20% would be paid to Franklin, less charges, when the receivable is collected in full. Any amount outstanding after three months would be transferred back to Franklin; Aretha charges 3% per month of the net amount owing at the end of each month. On 1 December 2017 Franklin debited the cash received from Aretha to its bank account, removed the trade receivable from its records and charged the difference to operating expenses. Aretha had not collected any of the amounts owing at 31 December 2017.

7. The directors of Franklin have estimated that tax of 2,000,000 will be due on profits for the year ended 31 December 2017. This includes 500,000 in respect of the discontinued activities referred to in Note 5.

Requirement:

Prepare the statement of profit or loss and other comprehensive income of Franklin for the year ended 31 December 2017 and the statement of financial position as at that date.

Step by Step Answer:

International Financial Accounting And Reporting

ISBN: 9781912350025

6th Edition

Authors: Ciaran Connolly