Global Sales Company, a U.S. corporation that has customers in several foreign (L.O. 5) countries, had the

Question:

Global Sales Company, a U.S. corporation that has customers in several foreign

(L.O. 5) countries, had the following transactions in 1990 and 1991.

1990 July 16 Sold merchandise for 950,000 yen to Shisedu Company of Japan, payment in full to be received in 60 days. On this day, the current foreign exchange rate for yen into dollars was \(\$ 0.007897\).

Aug. 21 Sold merchandise to Klaus Retailers of West Germany for \(\$ 9,500\) cash. The foreign exchange rate for marks into dollars was \(\$ 0.6027\).

Sept. 14 Received Shisedu Company's payment for its purchase of July 16, and exchanged the yen for dollars. The exchange rate for yen into dollars was \(\$ 0.007779\).

Oct. 6 Sold merchandise on credit to Trafalgar Distributors, Inc., a company located in London. The price of 5,000 pounds was to be paid 90 days from the date of sale. On October 6, the foreign exchange rate for pounds into dollars was \(\$ 1.7644\).

Nov. 18 Sold merchandise for 30,000 francs to Belgique Suppliers of Brussels, payment in full to be in 60 days. The exchange rate for Belgian francs into dollars was \(\$ 0.2818\).

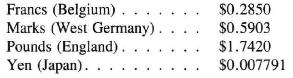

Dec. 31 Prepared adjusting entries to recognize exchange gains or losses on the annual financial statements. Rates of exchanging foreign currencies into dollars on this day included the following:

1991 Jan. 4 Received Trafalgar Distributors, Inc.'s full payment for the sale of October 6, and exchanged the pounds for dollars. The exchange rate for pounds into dollars was \(\$ 1.7695\).

17 Received full payment from Belgique Suppliers for the sale of November 18, and exchanged the francs for dollars. The exchange rate for francs into dollars was \(\$ 0.2822\).

\section*{Required}

1. Prepare general journal entries to account for these transactions of Global Sales Company.

2. Calculate the exchange gain or loss to be reported on Global Sales Company's 1990 income statement.

Step by Step Answer: