James Piper, a lawyer, has always kept his records on a cash basis; at the end of

Question:

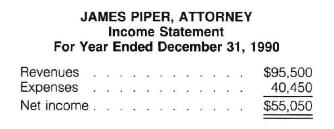

James Piper, a lawyer, has always kept his records on a cash basis; at the end of 1990, he prepared the following cash basis income statement.

In preparing the statement, the following amounts of prepaid, unearned, and accrued items were ignored at the end of 1989 and 1990.

\section*{Required}

Under the assumptions that the 1989 prepaid expenses were consumed or expired in 1990, the 1989 unearned revenues were earned in 1990 , and the 1989 accrued items were either paid or received in cash in 1990, prepare a 1990 accrual basis income statement for James Piper's law practice. Attach to your statement calculations showing how you arrived at each 1990 income statement amount.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: