Kwella Ltd received the following invoices from suppliers during the week commencing 23 November 20X4. All purchases

Question:

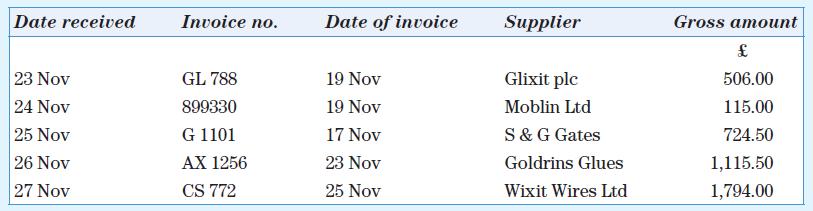

Kwella Ltd received the following invoices from suppliers during the week commencing 23 November 20X4. All purchases made by Kwella Ltd are subject to value added tax at 15 per cent. The following list gives the gross value of each invoice received.

On 25 November Kwella Ltd rejected all the goods invoiced on 19 November by Moblin Ltd (invoice no. 899330) because they were not what had been ordered. The goods were returned to Moblin Ltd along with Kwella Ltd’s debit note (D 56) for the full invoice amount.

On 26 November Kwella Ltd had to return some of the goods purchased on 17 November from S & G Gates (invoice no. G 1101) because they were substandard. A debit note (D 57) for a gross value of £241.50 was returned with the goods.

Required

a. Write up Kwella Ltd’s purchases book and purchases returns book for the week commencing 23 November 20X4, totalling the columns off as at 28 November 20X4.

b. Describe how the information in the purchases book and purchases returns book would be incorporated into Kwella Ltd’s ledger.

c. The balance brought forward on S & G Gates’ account at 1 November 20X4 was £920.00, which Kwella Ltd settled in full by cheque on 13 November after deducting 5 per cent discount. There were no transactions with S & G Gates during the month of November other than those detailed above.

Reconstruct Kwella Ltd’s ledger account for S & G Gates for the month of November 20X4, balancing off the account as at 30 November 20X4.

Step by Step Answer: