Lou Cass, Red Sanders, and Barbara Archer formed the CSA Partnership by making capital contributions of ($

Question:

Lou Cass, Red Sanders, and Barbara Archer formed the CSA Partnership by making capital contributions of \(\$ 116,640, \$ 129,600\), and \(\$ 142,560\), respectively. They anticipate annual net incomes of \(\$ 195,000\) and are considering the following alternative plans of sharing net incomes and losses:

(a) equally;

(b) in the ratio of their initial investments; or

(c) salary allowances of \(\$ 35,000\) to Cass, \(\$ 20,000\) to Sanders, and \(\$ 45,000\) to Archer, interest allowances of \(10 \%\) on initial investments, with any remaining balance shared equally.

\section*{Required}

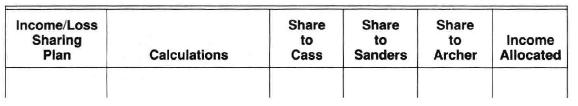

1. Prepare a schedule with the following column headings:

Use the schedule to show how a net income of \(\$ 195,000\) would be distributed under each of the alternative plans being considered. Round your answers to the nearest whole dollar.

2. Prepare the December 31 journal entry to close the Income Summary account assuming they agree to use alternative

(c) and the net income is \(\$ 85,000\).

(Show your supporting calculations.)

Step by Step Answer: