Maraid, Wendy and Diane have been in partnership for a number of years sharing profits _25_ ,

Question:

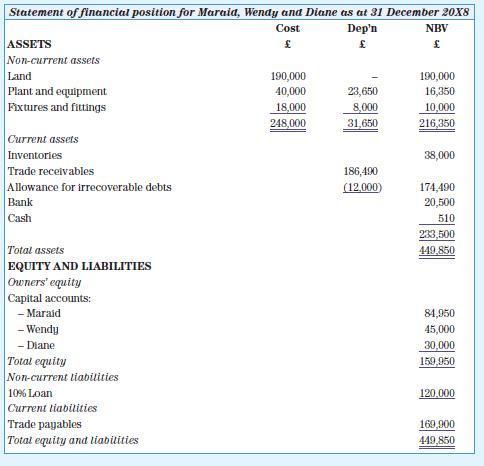

Maraid, Wendy and Diane have been in partnership for a number of years sharing profits _25_ , _ 25_ and _ 15_ , respectively. They decide to form a limited company on 1 January 20X9, called McKee Ltd, to carry on the business. The statement of financial position of the partnership on 31 December 20X8 is as follows:

Additional information

The updated statement of financial position information at 31 December 20X8 is as follows:

1. The land is valued at £210,000 on 31 December 20X8.

2. A machine that was purchased for £10,000 on 1 January 20X6 is now considered to be worthless. Machines are depreciated using the sum of digits method over a period of four years. On 1 January 20X9 the partners considered that this machine would have a residual value of £2,000. (The figures in the statement of financial position above have been adjusted for 20X8’s depreciation charge.)

3. The financial statements for the period ended 31 December had omitted the accountancy fee for that period of £3,000.

4. During a review of the inventory on 31 December 20X8, items valued in the books at £9,000 were considered to be worth £1,000.

5. The partners received information that one of their customers, Seamus, is declared bankrupt. On investigation, it is estimated that Seamus will only be able to pay 20p for each £1 he owes. Seamus owes the partnership £50,000.

6. A full year’s interest is still outstanding and has not yet been accrued in the above draft figures.

Required

Provide the relevant entries required for amending the statement of financial position to take account of the new up-to-date information and prepare the new updated statement of financial position.

Step by Step Answer:

Introduction To Financial Accounting

ISBN: 9781526803009

9th Edition

Authors: Anne Marie Ward, Andrew Thomas