Maxima Company purchased machinery for ($ 675,000) on December 30, 1987. The equipment was expected to last

Question:

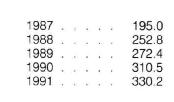

Maxima Company purchased machinery for \(\$ 675,000\) on December 30, 1987. The equipment was expected to last eight years and have no salvage value; straightline depreciation was to be used. The equipment was sold on December 31, 1991, for \(\$ 525,000\). End-of-year general price index numbers during this period of time were as follows:

\section*{Required}

(Round all answers to the nearest whole dollar.)

1. What should be presented for the equipment and accumulated depreciation on a historical cost/constant purchasing power balance sheet dated December 31, 1989? Hint: Depreciation is the total amount of cost that has been allocated to expense. Therefore, the price index numbers that are used to adjust the nominal dollar cost of the asset should also be used to adjust the nominal dollar amount of depreciation.

2. How much depreciation expense should be shown on the historical cost/constant purchasing power income statement for 1990?

3. How much depreciation expense should be shown on the historical cost/constant purchasing power income statement for 1991?

4. How much gain on the sale of equipment would be reported on the historical costominal dollar income statement for 1991?

5. After adjusting the equipment's cost and accumulated depreciation to the end-of-1991 price level, how much gain in (loss of) purchasing power was realized by the sale of the equipment?

Step by Step Answer: