Revenue Recognition Footnote 1 to Microsoft's 2002 annual report contained the following: Revenue Recognition Microsoft... recognizes revenue

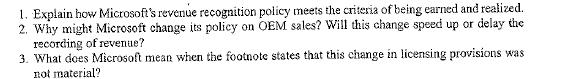

Question:

Revenue Recognition Footnote 1 to Microsoft's 2002 annual report contained the following: Revenue Recognition "Microsoft... recognizes revenue when (i) persuasive evidence of an arrangement exists; (ii) delivery has occurred or services have been rendered; (iii) the sales price is fixed or determinable; and (iv) collectibility is reasonably assured... Revenue from products licensed to original equipment manufacturers (OEMs) is based on the licensing agreement with an OEM and has historically been recog- nized when OEMs ship licensed products to their customers. Licensing provisions were modified with the introduction of Windows XP in 2002 and revenue for certain products is recorded upon shipment of the product to OEMs. The effect of this change in licensing provisions was not material. Revenue from packaged product sales to distributors and resellers is usually recorded when related products are shipped. However, when the revenue recognition criteria required for distributor and reseller arrangements are not met, revenue is recognized as payments are received. Revenue related to the Company's Xbox game console is recognized upon shipment of the product to retailers. Online advertising revenue is recognized as advertisements are displayed."

Step by Step Answer:

Introduction To Financial Accounting

ISBN: 0131479725

9th Edition

Authors: Charles T Horngren, John A Elliott