Sara Cloud established Sara's Boutique in January 19X4 to import woolens from Scotland. During 19X4 and 19X5

Question:

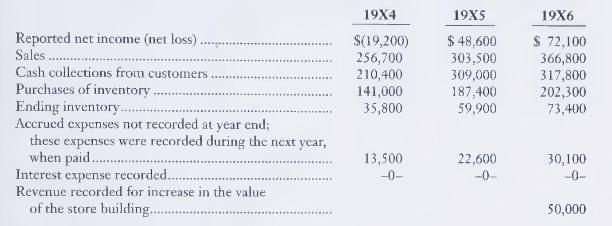

Sara Cloud established Sara's Boutique in January 19X4 to import woolens from Scotland. During 19X4 and 19X5 Cloud kept the company's books and prepared the financial statements, although she had no training or experience in accounting. As a result, the accounts contain numerous errors. Cloud recorded revenue from sales on the collection method, which is not appropriate for the company. She should have been using the sales method for revenues. She also recorded inventory purchases as the cost of goods sold.

When the value of the store building increased by \(\$ 50,000\) in \(19 \times 6\), Cloud recorded an increase in the Building account and credited Revenue. On January 2, 19X4, she borrowed \(\$ 30,000\) on a 9 -percent, three-year note. She intended to wait until \(19 \times 7\), when the note was due, to record the full amount of interest expense for three years. The company's records reveal the following:

\section*{Required}

1. In early 19X7 Cloud employed you as an accountant. Apply the concepts and principles of GAAP to compute the correct net income of Sara's Boutique for 19X4, 19X5, and 19X6.

2. How will what you learned in this problem help you manage a business?

Step by Step Answer:

Financial Accounting

ISBN: 9780133118209

2nd Edition

Authors: Charles T. Horngren, Jr. Harrison, Walter T.