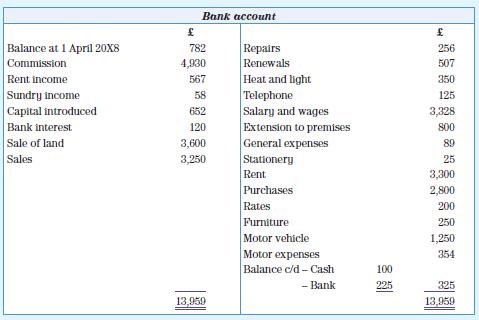

T. Murray has prepared the following bank ledger account for the year ended 31 March 20X9: T.

Question:

T. Murray has prepared the following bank ledger account for the year ended 31 March 20X9:

T. Murray has also supplied you with the following information.

a. Commissions received included £85, which had been in arrears at 31 March 20X8, and £55, which had been paid for the year commencing 1 April 20X9. In addition, three customers still owed commission for the year to 31 March 20X9. One was commission for a type A product (£15), the other two were commission for the sale of type B products (£45).

b. The land that was sold was valued in the company’s books at £1,500.

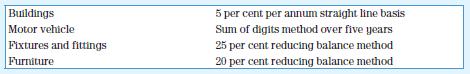

c. Depreciation is to be charged as follows.

A full year’s depreciation is charged in the year of purchase but none is charged in the year of sale.

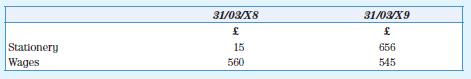

d. Accrued expenses:

The electricity bill for the period to 30 April 20X9 (£450) was paid for on 23 May 20X9.

The rent paid in advance was to cover three full financial years including 20X8.

The interest received in the year is for the period from 1 April 20X8 to 31 December 20X8.

e. General expenses includes an amount of £35 for a telephone bill that was posted here in error.

f. The closing inventory has been valued at £990.

g. Repairs include £200, which was paid for a brand new pool table.

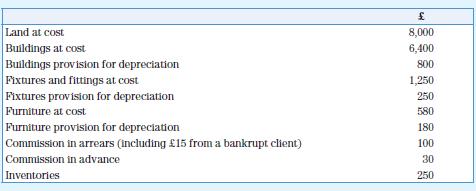

h. The following balances are from T. Murray’s books at 31 March 20X8:

Required

a. Prepare the opening statement of financial position for T. Murray as at 31 March 20X8.

b. Prepare the statement of profit or loss for T. Murray for the year ended 31 March 20X9.

c. Prepare the statement of financial position for T. Murray as at 31 March 20X9.

Step by Step Answer:

Introduction To Financial Accounting

ISBN: 9781526803009

9th Edition

Authors: Anne Marie Ward, Andrew Thomas