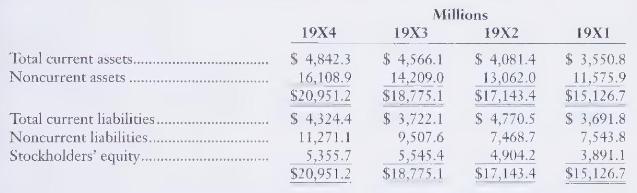

The balance sheets of PepsiCo, Inc., for four years reported these figures: The notes to PepsiCo's (19

Question:

The balance sheets of PepsiCo, Inc., for four years reported these figures:

The notes to PepsiCo's \(19 \mathrm{X} 4\) financial statements report that during 19X3, the company reclassified \(\$ 3,450\) million of current liabilities as long-term. And during 19X4, PepsiCo reclassified a further \(\$ 3,500\) million as long-term.

\section*{Required}

1. Compute PepsiCo's current ratio at the end of each year. Describe the trend that you observe.

2. Assume that PepsiCo had not reclassified current liabilities as long-term but instead had paid the current liabilities in due course. Recompute the current ratios for 19X3 and 19X4. Why do you think PepsiCo reclassified the liabilities as long-term? What could the company do to justify the reclassification?

Step by Step Answer:

Financial Accounting

ISBN: 9780133118209

2nd Edition

Authors: Charles T. Horngren, Jr. Harrison, Walter T.