The directors of J. Kitchens Ltd were pleased when their accountants informed them that the company had

Question:

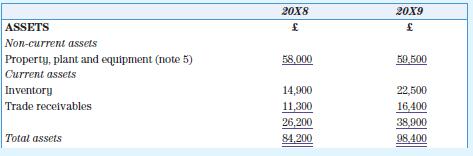

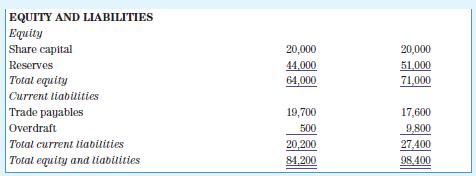

The directors of J. Kitchens Ltd were pleased when their accountants informed them that the company had made a profit of £24,000 during the year ended 31 December 20X9. However, their pleasure was turned into confusion when the cashier showed them a letter he had received from their banker. This indicated that he had reviewed Kitchens’ account and was concerned to note the deterioration in their bank position. During 20X9 a small overdraft of £500 had reached £9,800 and was nearing the limit of their security. The directors would like to see an explanation of this increased overdraft, particularly as they had declared lower dividends than for the previous year. You are given the statements of financial position at 31 December 20X8 and 31 December 20X9:

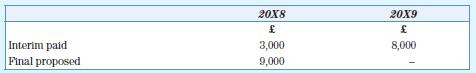

1. Dividends

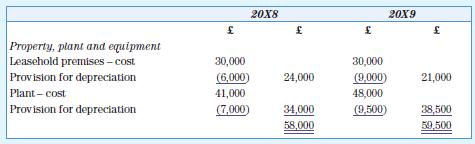

2. During the year, plant costing £10,000 with a net book value of £6,000 was sold for £6,400.

3. The amount included for trade receivables at 31 December 20X9 is after making an allowance for irrecoverable receivables of £600 (20X8: £400).

4. During the year ended 31 December 20X9 £750 was paid in bank interest.

5. Property, plant and equipment is made up of the following:

Required

You are required to prepare a statement of cash flows in accordance with IAS 7 for the year 20X9 showing why the overdraft has increased.

Step by Step Answer:

Introduction To Financial Accounting

ISBN: 9781526803009

9th Edition

Authors: Anne Marie Ward, Andrew Thomas