The partnership of Monet, Blair, & Trippi has experienced operating losses for three consecutive years. The partners,

Question:

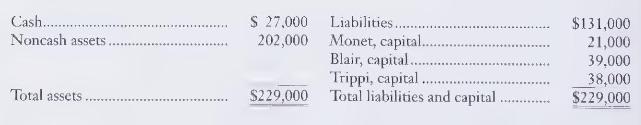

The partnership of Monet, Blair, \& Trippi has experienced operating losses for three consecutive years. The partners, who have shared profits and losses in the ratio of Mindy Monet, 10 percent; Burt Blair, 30 percent; and Toni Trippi, 60 percent, are considering the liquidation of the business. They ask you to analyze the effects of liquidation under various possibilities regarding the sale of the noncash assets. They present the following condensed partnership balance sheet at December 31, end of the current year:

\section*{Required}

1. Prepare a summary of liquidation transactions (as illustrated in the chapter) for each of the following situations:

a. The noncash assets are sold for \(\$ 212,000\).

b. The noncash assets are sold for \(\$ 182,000\).

2. Make the journal entries to record the liquidation transactions in Requirement \(1 \mathrm{~b}\).

Step by Step Answer:

Financial Accounting

ISBN: 9780133118209

2nd Edition

Authors: Charles T. Horngren, Jr. Harrison, Walter T.