The purpose of this problem is to familiarize you with the financial statement information of a real

Question:

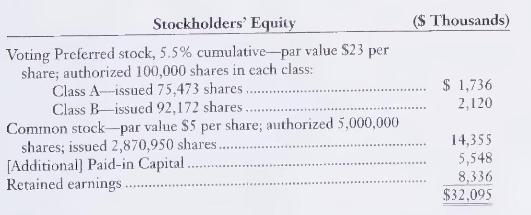

The purpose of this problem is to familiarize you with the financial statement information of a real company, \(\mathrm{U}\) and I Group. \(\mathrm{U}\) and \(\mathrm{I}\), which makes food products and livestock feeds, included the following stockholders' equity on its year-end balance sheet at February 28:

\section*{Required}

1. Identify the different issues of stock \(U\) and \(I\) has outstanding.

2. Give the summary entries to record issuance of all the \(U\) and \(I\) stock. Assume that all the stock was issued for cash and that the additional paid-in capital applies to the common stock. Explanations are not required.

3. Rearrange the \(\mathbf{U}\) and \(\mathrm{I}\) stockholders' equity section to correspond, as appropriate, to the format and terminology illustrated on page 575.

4. Suppose U and I passed its preferred dividends for one year. Would the company have to pay those dividends in arrears before paying dividends to the common stockholders? Give your reason.

5. What amount of preferred dividends must \(U\) and \(I\) declare and pay each year to avoid having preferred dividends in arrears?

6. Assume that preferred dividends are in arrears for \(19 \mathrm{X} 8\).

a. Write Note 5 of the February 28, 19X8, financial statements to disclose the dividend in arrears.

b. Record the declaration of a \(\$ 450,000\) dividend in the year ended February 28, 19X9. An explanation is not required.

Step by Step Answer:

Financial Accounting

ISBN: 9780133118209

2nd Edition

Authors: Charles T. Horngren, Jr. Harrison, Walter T.