The Rocky Mountain Power Company general ledger at September 30, 19X7, the end of the company's fiscal

Question:

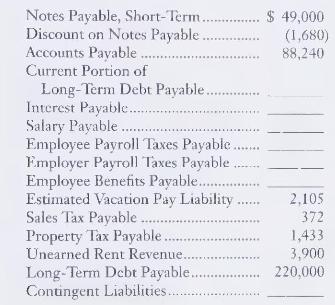

The Rocky Mountain Power Company general ledger at September 30, 19X7, the end of the company's fiscal year, includes the following account balances before adjusting entries. Parentheses indicate a debit balance.

The additional data needed to develop the adjusting entries at September 30 are as follows:

a. The \(\$ 49,000\) balance in Notes Payable, Short-Term consists of two notes. The first note, with a principal amount of \(\$ 21,000\), was issued on August 31 , matures one year from date of issuance, and was discounted at 8 percent. The second note was issued on September 2 for a term of 90 days and bears interest at 7 percent. It was not discounted.

b. The long-term debt is payable in annual installments of \(\$ 55,000\), with the next installment due on January 31, 19X8. On that date, Rocky Mountain Power will also pay one year's interest at 6.5 percent. Interest was last paid on January 31. Shift the current installment of the long-term debt to a current liability.

c. Gross salaries for the last payroll of the fiscal year were \(\$ 4,319\). Of this amount, employee payroll taxes payable were \(\$ 958\), and salary payable was \(\$ 3,361\).

d. Employer payroll taxes payable were \(\$ 755\), and Rocky Mountain Power's liability for employee life insurance was \(\$ 1,004\).

e. Rocky Mountain Power estimates that vacation pay is 4 percent of gross salaries.

f. On August 1 the company collected six months' rent of \(\$ 3,900\) in advance.

g. At September 30 Rocky Mountain Power is the defendant in a \(\$ 500,000\) lawsuit, which the company hopes to win. However, the outcome is uncertain. Report this contingent liability in the appropriate manner.

\section*{Required}

1. Open the listed accounts, inserting their unadjusted September 30 balances.

2. Journalize and post the September 30 adjusting entries to the accounts opened. Key adjusting entries by letter.

3. Prepare the liability section of Rocky Mountain Power's balance sheet at September 30.

Using a payroll register, recording a payroll (Obj. 5)

Reporting current liabilities (Obj. 6)

Step by Step Answer:

Financial Accounting

ISBN: 9780133118209

2nd Edition

Authors: Charles T. Horngren, Jr. Harrison, Walter T.