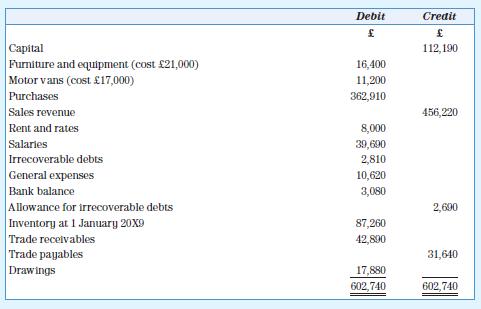

The trial balance extracted from the books of Mary, a sole trader, as at 31 December 20X9

Question:

The trial balance extracted from the books of Mary, a sole trader, as at 31 December 20X9 was as follows:

Additional information

1. Inventory on hand on 31 December 20X9 is £94,280.

2. Rates paid in advance at 31 December 20X9 are £600.

3. General expenses unpaid at 31 December 20X9 are £1,660.

4. Allowance for irrecoverable debts is to be adjusted to £2,410.

5. A motor van purchased on 1 January of this year at a cost of £8,000 was traded in for £3,500 on 31 December 20X9 and a new van purchased at a cost of £10,000 on the same day. The amount due on the new van was payable on 1 January 20Y0. No entries had been made in the books in respect of this transaction when the trial balance at 31 December 20X9 was extracted.

6. Depreciation is to be charged on furniture and equipment at the rate of 5 per cent per annum on

cost and at the rate of 25 per cent per annum (reducing balance method) on motor vehicles.

Required

Prepare Mary’s statement of performance for the year ended 31 December 20X9 and statement of financial position as at 31 December 20X9.

Step by Step Answer:

Introduction To Financial Accounting

ISBN: 9781526803009

9th Edition

Authors: Anne Marie Ward, Andrew Thomas