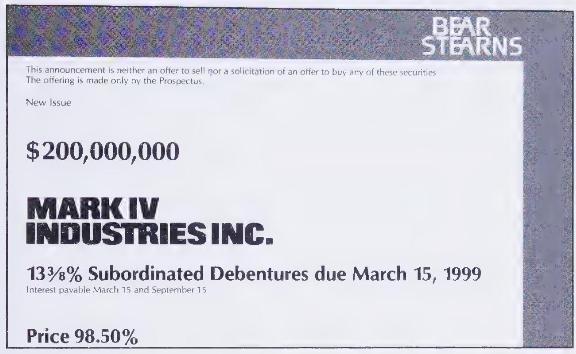

This (partial) advertisement appeared in The Wall Street Fournal. section*{Required} Answer these questions: 1. Suppose investors purchased

Question:

This (partial) advertisement appeared in The Wall Street Fournal.

\section*{Required}

Answer these questions:

1. Suppose investors purchased these securities at their offering price on March 15, 1989. Describe the transaction in detail, indicating who received cash, who paid cash, and how much.

2. Why is the contract interest rate on these bonds so high?

3. Compute the annual cash interest payment on the bonds.

4. Compute the annual interest expense under the straight-line amortization method.

5. Compute both the first-year (from March 15, 1989) and the second-year interest expense under the effective-interest amortization method. The market rate of interest at the date of issuance was approximately 13.65 percent.

6. Suppose you purchased \(\$ 100,000\) of these bonds on March 15, 1989. How much cash did you pay? If you had purchased \(\$ 100,000\) of these bonds on March 31,1989 , how much cash would you have paid?

Step by Step Answer:

Financial Accounting

ISBN: 9780133118209

2nd Edition

Authors: Charles T. Horngren, Jr. Harrison, Walter T.