You are the Finance Director of Thompson Group plc (Thompson), a group of companies that imports, blends

Question:

You are the Finance Director of Thompson Group plc (“Thompson”), a group of companies that imports, blends and packs high quality tea for sale to the retail trade. Thompson prepares its financial statements to 31 December each year, and you have just extracted the following trial balance as at 31 December 2017 from the group’s books and records:

Additional Information:

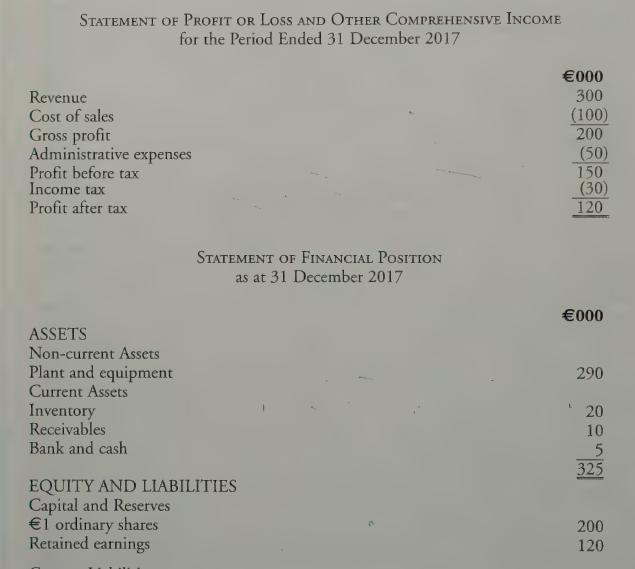

1. On 1 January 2017, Thompson purchased 60,000 €1 ordinary shares in Ross Limited (“Ross”), a company that is involved in the tea trade but whose focus is on the price of the product rather than the quality. The retained earnings of Ross stood at €170,000 on 1 January 2017, and the net assets of Ross had a fair value that was the same as their book value. The statement of profit or loss and other comprehensive income of Ross fo the year ended 31 December 2017, and the statement of financial position as at that date, are shown below:

Only the cost of the investment in Ross is included in Thompson's trial balance as at 31 December 2017. The directors of Thompson estimate that the goodwill arising on the acquisition of Ross was impaired by €39,000 during the year ended 31 December 2017. | Ss . During the year ended 31 December 2017, Thompson became involved in a joint arrangement with Graeme Incorporated (“Graeme”) with a view to expanding their operations to other countries. Thompson and Graeme each purchased 50% of the ordinary share capital in a new entity, David Limited (“David”). Under the terms of the joint arrangement, Thompson and Graeme have rights to the net assets of the arrangement.

Neither Thompson nor Graeme is able to control David-without the support of the other, and all decisions on financial and operating policy, economic performance and financial position require the consent of both Thompson and Graeme. The following information is available with respect to David’s activities during the year ended 31 December 2017.

Only the cost of the investment in David is included in Thompson’s trial balance as at 31 December 2017. The directors of Thompson are confident that any goodwill arising on the acquisition of David has not been impaired at 31 December 2017.

3. The property shown in the trial balance was acquired a number of years ago and the estimated useful economic life was 50 years at the time of purchase. As at 31 December 2017, the property is to be revalued to €1,000,000.

It is group policy to provide a full year’s depreciation in the year of acquisition and none in the year of disposal. All depreciation is charged to administrative expenses and is calculated as follows:

Property — straight-line over estimated useful economic life;

Plant and equipment — 10% straight-line.

Thompson's inventory at 31 December 2017 is valued by the directors at €275,000.

Included in this figure is speciality tea valued at its original cost of €60,000. The replacement cost of the tea is €30,000 and its market value, based upon sales in January and February 2018, is €50,000 before selling and distribution costs of €5,000.

. The 10% debentures were issued on 1 January 2017 and are redeemable on 31 December 2021. Interest is paid quarterly in arrears and the first payment was due on 1 April 2017.

In February 2018, Thompson received a claim from a former employee for €25,000 alleging discrimination at work and unfair dismissal in October 2017. While the directors refute the claim, they believe the courts are likely to uphold it. As the claim was received in 2018, the directors have decided not to account for it in 2017 and wait until the outcome of the case is known with certainty. The directors believe the case will not be resolved until 2019.

There is no trading between Thompson, Ross, Graeme and David, and there was no change in the share capital of the companies during 2017.

Thompson's tax charge for 2017, which takes into account all relevant items, is €325,250.

Requirement Prepare the consolidated statement of profit or loss and other comprehensive income for Thompson for the year ended 31 December 2017 and the consolidated statement of financial position as at that date.

Step by Step Answer:

International Financial Accounting And Reporting

ISBN: 9781912350025

6th Edition

Authors: Ciaran Connolly