You are the management accountant of Psychedelic Limited, a company that makes up its financial statements to

Question:

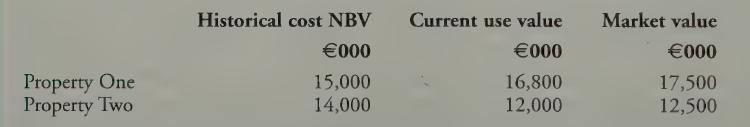

You are the management accountant of Psychedelic Limited, a company that makes up its financial statements to 30 September each year. The financial statements for the year ended 30 September 2017 are currently being prepared. The directors have always included non- current assets under the historical cost convention. However, for the current year they are considering revaluing some of the non-current assets. They obtained professional valuations as at 1 October 2016 for the two properties owned by the company. Details of the valuations were as follows:

No acquisitions or disposals of properties have taken place since 1 October 2016 and none is expected in the near future. The buildings element of the two properties comprises 50% of both historical cost and the revalued amounts. Each property is believed to have a useful economic life to the company of 40 years from 1 October 2016. Given the results of the valuations, the directors propose to include Property One at its mar- ket value in the financial statements for the year to 30 September 2017. They wish to leave Property Two at its historical cost. They have no plans to revalue the other non-current assets of the company, which are plant and fixtures.

Requirement:

(a) Evaluate the directors' proposal to revalue Property One as at 1 October 2016 but to leave all other non-current assets at historical cost.

(b) The directors have decided to revalue the non-current assets of the company in accordance with their original wishes, amended, where necessary, to comply with appropriate IFRSS. Calculate the carrying value of each property as at 30 September 2017. You should clearly explain where any differences on revaluation will be shown in the financial statements.

Step by Step Answer:

International Financial Accounting And Reporting

ISBN: 9781912350025

6th Edition

Authors: Ciaran Connolly