Province Limited (Province), an Irish company that prepares its financial statements to 31 December each year, is

Question:

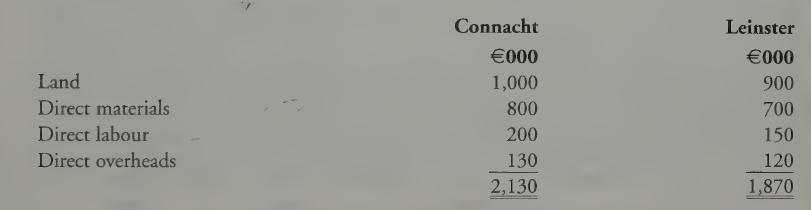

Province Limited ("Province"), an Irish company that prepares its financial statements to 31 December each year, is involved in a range of different leisure-related activities through- out Ireland. At 31 December 2017, the company owned four properties: Connacht, Leinster, Munster and Ulster. Further information on these properties is provided below. On 1 January 2016, Province acquired Connacht and Leinster, two sites located in out-of- town shopping centers, with the intention of building a multi-screen cinema on each. Construction on each site commenced on 1 January 2016 and was completed on 31 December 2016. Details of the costs associated with the construction are as follows:

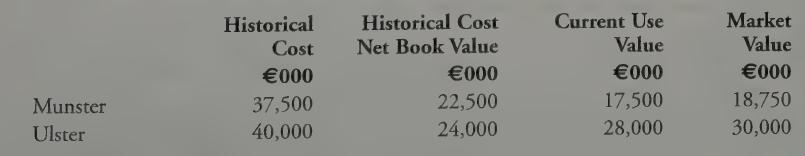

Province financed the construction of Connacht and Leinster by issuing a 5,000,000 zero coupon bond on 1 January 2016. The bond is redeemable on 31 December 2019 with a one-off payment of 6,802,721. While both properties were brought into use on 1 January 2017, Connacht was retained by Province for use as a cinema and Leinster was let at a commercial rent to an unrelated company that was able to easily convert the property into a 10-pin bowling alley. Province owns two successful four-star country hotels, Munster and Ulster, and the company intends to develop this specialist part of its business. These two properties were professionally valued on 1 January 2017, the details of which are as follows:

The buildings element of Munster and Ulster represents 50% of both the historical cost and revalued amounts, and their remaining useful economic life at 1 January 2017 was 30 years. It was company policy to record all owned properties at historical cost and to depreciate them over their estimated useful economic life of 50 years on a straight-line basis. However, with effect from 1 January 2017, the directors of Province have decided to record Munster and Ulster at valuation in the financial statements. The directors do not intend to obtain valuations for Connacht and Leinster, or other non-current assets held by the company. It is company policy to include finance costs in the cost of non-current assets, where permitted by extant international accounting standards.

Requirement:

(a) Explain whether Province is permitted to record Munster and Ulster at valuation and other non-current assets, including Connacht and Leinster, at depreciated historical cost.

(b) Based on the information provided, show the amounts that should be included in the statements of profit or loss and other comprehensive income of Province for the years ended 31 December 2016 and 2017, and the statements of financial position as at those dates, in respect of the four properties.

Step by Step Answer:

International Financial Accounting And Reporting

ISBN: 9781912350025

6th Edition

Authors: Ciaran Connolly