Dave Skold owns and operates a small chain of convenience stores in Waterloo and Poitiers. The company

Question:

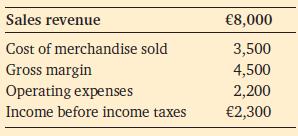

Dave Skold owns and operates a small chain of convenience stores in Waterloo and Poitiers. The company has five stores including a downtown store and a store in the Waterloo division; and a downtown store, a Solon store and an airport store in the Poitiers Division. There is also a separate administrative staff that provides market research, personnel and accounting and finance services. The company had the following financial results for 20X1 (in thousands):

The following data about 20X1 operations were also available:

1. All five stores used the same pricing formula; therefore, all had the same gross margin percentage.

2. Sales were largest in the two downtown stores, with 30 per cent of the total sales volume in each. The Solon and airport stores each provided 15 per cent of total sales volume and the store provided 10 per cent.

3. Variable operating costs at the stores were 10 per cent of revenue for the downtown stores. The other stores had lower variable and higher fixed costs. Their variable operating costs were only 5 per cent of sales revenue.

4. The fixed costs over which the store managers had control were €125,000 in each of the downtown stores, €160,000 at Solon and airport, and €80,000 at the store. 5 The remaining €910,000 of operating costs consisted of

(a). €210,000 controllable by the Cedar Rapids division manager but not by individual stores,

(b). €100,000 controllable by the Waterloo division manager but not by individual stores, and

(c). €600,000 controllable by the administrative staff .

6. Of the €600,000 spent by the administrative staff, €350,000 directly supported the Poitiers division, with 20 per cent for the downtown store, 30 per cent for each of the Solon and airport stores, and 20 per cent for Poitiers operations in general. Another €140,000 supported the Waterloo division, 50 per cent for the downtown store, 25 per cent for the store and 25 per cent supporting Waterloo operations in general. The other €110,000 was for general corporate expenses.

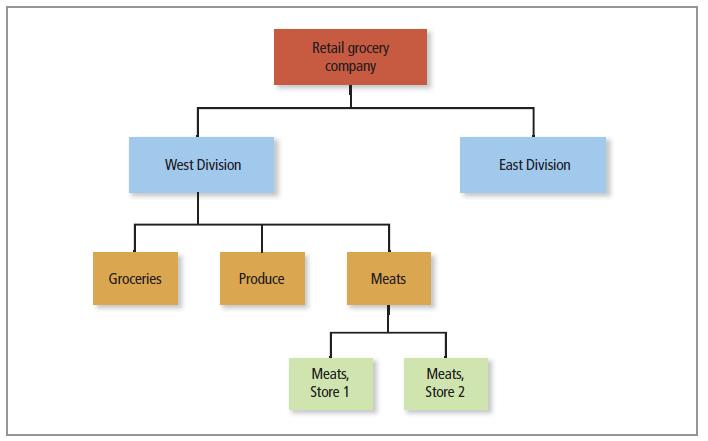

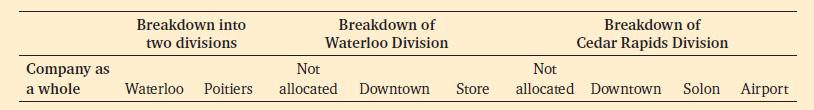

Prepare an income statement by segments using the contribution approach to responsibility accounting. Use the format of Exhibit 9.4, p. 385. Column headings should be as follows:

Exhibit 9.4

Step by Step Answer:

Introduction To Management Accounting

ISBN: 9780273737551

1st Edition

Authors: Alnoor Bhimani, Charles T. Horngren, Gary L. Sundem, William O. Stratton, Jeff Schatzberg