John Paul Hudik, president of Hudik Boat Hauling, is considering replacing the companys industrial lift used to

Question:

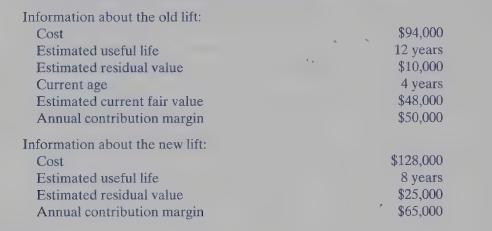

John Paul Hudik, president of Hudik Boat Hauling, is considering replacing the company’s industrial lift used to haul boats. The new lift would allow the company to lift larger boats out of the water. The company’s cost of capital is 14 percent.

Required:

a. Prepare a relevant cost schedule showing the benefit of buying the new lift. (For this requirement, ignore the time value of money.)

b. How much must the company invest today to replace the old lift?

c. If the company replaces the old lift, what is the increase in the company’s annual contribution margin?

d. If the company sells the old lift now to make room for the new one, it will not receive the \($10,000\) residual value at the end of its useful life. Instead, the company will receive the \($25,000\) residual value from the new lift. With this in mind, if the company buys the new lift, what is the change in the residual value the company is to receive at the end of the eight-year life of the equipment?

e. Calculate the net present value of replacing the old lift.

f. Do you think the company should replace the old lift?

Step by Step Answer:

Introduction To Management Accounting A User Perspective

ISBN: 9780130327505

2nd Edition

Authors: Michael L Werner, Kumen H Jones