Nonmanufacturing organisations often find it useful to allocate costs to products or services. Consider a hospital. The

Question:

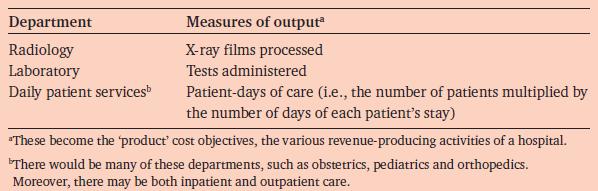

Nonmanufacturing organisations often find it useful to allocate costs to products or services. Consider a hospital. The output of a hospital is not as easy to define as the output of a factory. Assume the following measures of output in three revenue-producing departments:

Budgeted output for 20X7 is 60,000 X-ray films processed in radiology, 50,000 tests administered in the laboratory and 30,000 patient-days in daily patient services.

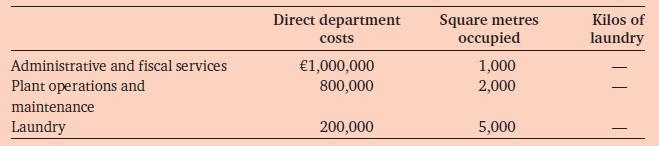

In addition to the revenue-producing departments, the hospital has three service departments:

administrative and fiscal services, plant operations and maintenance and laundry.

(Real hospitals have more than three revenue-producing departments and more than three service departments. This problem is simplified to keep the data manageable.)

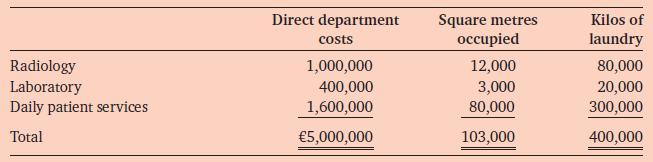

The hospital has decided that the cost-allocation base for administrative and fiscal services costs is the direct department costs of the other departments. The cost-allocation base for plant operations and maintenance is square feet occupied and for laundry is kilos of laundry. The pertinent budget data for 20X7 are as follows:

1. Allocate service department costs using the direct method.

2. Allocate service department costs using the step-down method. Allocate administrative and fiscal services first, plant operations and maintenance second and laundry third.

3. Compute the cost per unit of output in each of the revenue-producing departments using:

(a). The costs determined using the direct method for allocating service department costs (number 1) and

(b). The costs determined using the step-down method for allocating service department costs (number 2).

Step by Step Answer:

Introduction To Management Accounting

ISBN: 9780273737551

1st Edition

Authors: Alnoor Bhimani, Charles T. Horngren, Gary L. Sundem, William O. Stratton, Jeff Schatzberg