Review the example shown in Exhibit 11.2, p. 486. Conduct three independent sensitivity analyses as indicated next.

Question:

Review the example shown in Exhibit 11.2, p. 486. Conduct three independent sensitivity analyses as indicated next.

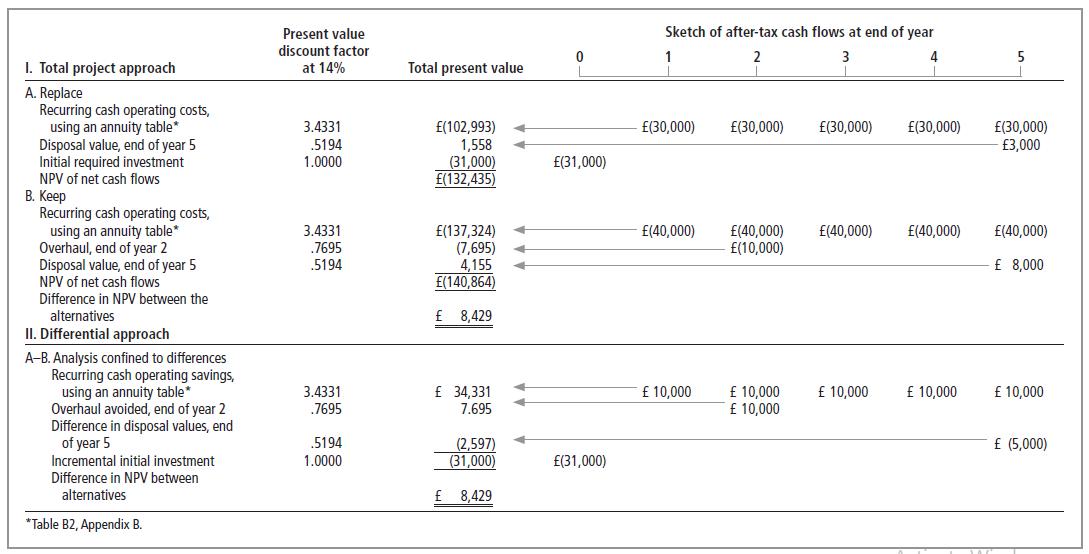

Exhibit 11.2

1. Compute the difference in the NPV of the alternatives if the minimum desired rate of return were 20 per cent instead of 14 per cent.

1. Compute the difference in the NPV of the alternatives if the minimum desired rate of return were 20 per cent instead of 14 per cent.

2. Compute the difference in the NPV of the alternatives if predicted cash operating costs of the new motor were £35,000 annually instead of £30,000, using the 14 per cent discount rate.

3. By how much may the annual cash operating savings fall short of the £10,000 predicted amount before the difference in NPV between the alternatives reaches zero? Use the original discount rate of 14 per cent?

Step by Step Answer:

Introduction To Management Accounting

ISBN: 9780273737551

1st Edition

Authors: Alnoor Bhimani, Charles T. Horngren, Gary L. Sundem, William O. Stratton, Jeff Schatzberg