The following question is based on the example given in E. Glad and H. Becker (1994: 39-45),

Question:

The following question is based on the example given in E. Glad and H. Becker (1994: 39-45), Activity-Based Costing and Management, Juta & Co Ltd, South Africa.

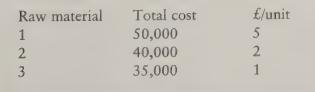

Three raw materials are used in the process, and purchases were

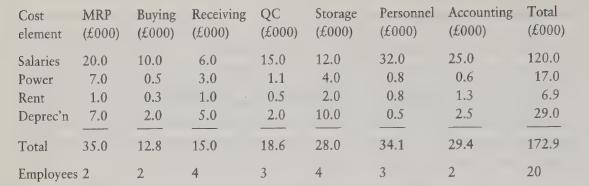

The overhead distribution summary is constructed each period, part of which follows:

The stationery cost is treated as a non-traceable item; the rent cost has been apportioned on the basis of floor area; and the depreciation values are determined from the fixed asset register.

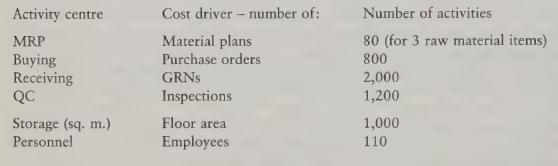

The cost drivers and the relevant number of activities are given below:

Required Calculate the cost per unit of the raw materials for this organisation.

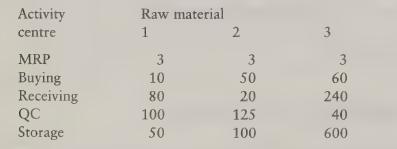

This table says, for example, raw material 1 requires 3 production plans to be completed for it, 10 purchase orders are issued in buying it, 80 goods-received notes will be issued in receiving all deliveries of it, and so on. The same applies to all three raw materials.

Step by Step Answer: